- NEXTBULL Masterclass

- Posts

- This Christmas, Gift Yourself the Profits You’ve Earned

This Christmas, Gift Yourself the Profits You’ve Earned

As the holiday season approaches, we’re all thinking about what gifts to give and receive.

But this year, I want to encourage you to give yourself the ultimate gift: profits.

Yes, you read that right — profits. Because let’s face it, just because your screen shows your crypto portfolio growing doesn’t automatically mean the money is landing in your bank account.

It’s time to start thinking about that next step.

Chirstmas gift

Lately, I’ve been getting messages from people who’ve never shown any interest in crypto — asking how to buy Bitcoin.

It’s a classic sign of the beginning of the euphoria phase. As more newcomers enter the market with fresh capital, the momentum builds, and that’s when we need to start thinking about taking some profits.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Before you start thinking I’m getting bearish, let me set the record straight — I’m not.

I still believe this crypto cycle has a long way to go, potentially lasting well into 2025. Based on past cycles, I expect crypto to peak somewhere between August and October 2025.

But who knows what will happen? We could see things speed up in December, or maybe the market will surge all the way to next November.

Regardless, one thing is certain: by the time 2025 arrives, you’ll want to have taken some profits.

Here’s the thing — taking profits isn’t a science. It’s more of an art form, and a very personal one at that. Your strategy will depend on your goals, how much you’ve invested, and your risk tolerance.

Bullmarket

That said, there are some general strategies that have worked for many. Some of them, you might have heard before, such as:

Price-based strategy: If a high-risk coin doubles in value, sell off your initial investment (or part of it) and leave the rest to grow. For instance, if you invest $10,000 into a coin and it grows to $20,000, sell $10,000 and convert it into cash or Bitcoin/Ethereum.

Timing-based strategy: Sell off 30% of your portfolio in December 2024 and another 30% in March 2025 — two months that are historically euphoric for the market.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

But here’s a different, perhaps smarter, approach that could suit you better if you prefer a more consistent and stress-free path.

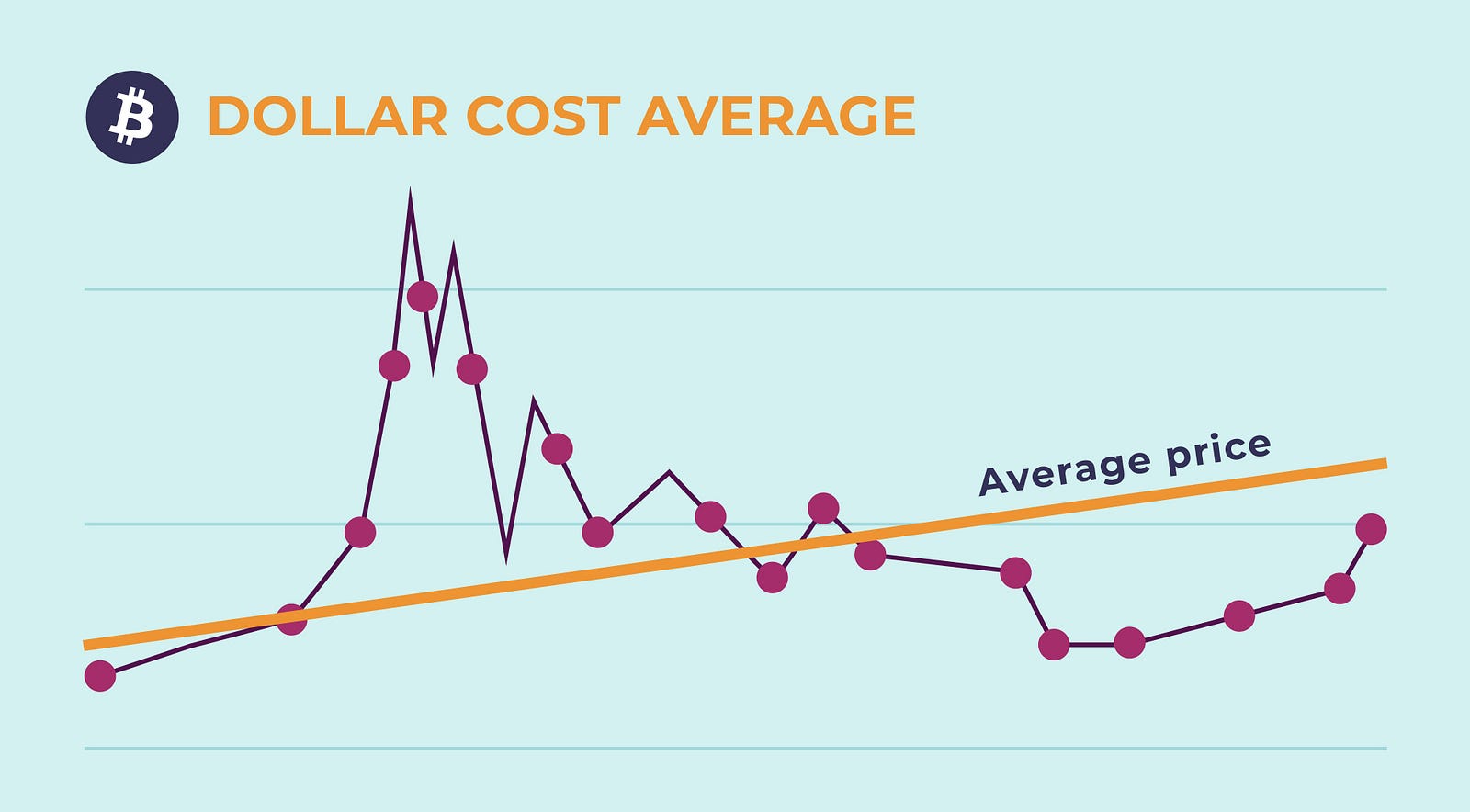

This method doesn’t rely on perfect timing or trying to chase the highest prices. Instead, you use a technique similar to dollar-cost averaging (DCA), which is commonly used for buying in. You apply it when selling too.

Dollar-cost averaging means buying a fixed amount of crypto at regular intervals, regardless of the market price.

DCA

While it may seem less aggressive than lump-sum investing, the beauty of DCA lies in its simplicity. It takes the emotion out of the equation, smoothing out the ups and downs of the market.

You can apply this same philosophy to selling: instead of trying to predict the market’s top, you regularly take profits by selling a set percentage of your holdings.

Why does this work? It helps you avoid the trap of extreme greed when the market is hot — thinking, “If I just wait a little longer, I’ll make even more!”

By regularly locking in profits, you avoid the risk of getting too greedy and failing to take any profits at all.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Now, let’s look at how this could work in practice.

A simple approach would be selling 1% of your portfolio every week over a defined period of time — say six months. If you want to be a bit more aggressive, you could bump it up to 2%.

Or, you could sell more when your assets hit new all-time highs, like what happened with Solana last week, and then return to smaller, steady sales afterward.

Think about this: each week, you’re selling a small, consistent percentage — maybe 1% or 2%. If things heat up and the market looks like it’s peaking, you can adjust and sell 10% or more of your holdings.

This way, you’re not trying to time the perfect top, but you’re still capitalizing on the market’s growth. The key is to have a plan and stick to it, even if you’re not getting the absolute best exit price.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

By the time the market starts to cool down, and we enter the bear phase, you can simply shift gears and start buying back in at lower prices.

It’s a flexible, low-stress strategy that ensures you’re always taking profits in a bull market — and ready to buy again when prices drop.

It’s not a flawless system, but it’s a solid one. If you’ve struggled with taking profits in the past, or if you find yourself hesitating when the market’s hot, this approach might be exactly what you need.

Because in the end, life-changing wealth doesn’t really change your life until you put it to work for you.

So, this holiday season, give yourself a gift you’ll truly appreciate — profits.

It’s a strategy that allows you to ride the market, take regular profits, and still participate in the next big wave.

The gift of a well-planned exit strategy could be the most valuable present you give yourself this year.

Enjoyed this read? Join 5,211+ crypto enthusiasts in our email newsletter and level up your crypto game! Don’t forget to clap if you want more content like this!