- NEXTBULL Masterclass

- Posts

- The $900,000 Mistake: How to Take Profits the Right Way

The $900,000 Mistake: How to Take Profits the Right Way

The key to winning in crypto isn’t just about picking the right assets; it’s about knowing when to secure profits.

Imagine watching your portfolio swell to $900,000 just shy of that coveted $1,000,000 mark.

You hold on, convinced that a little more patience will push you over the top. Instead, the market shifts, your gains evaporate, and now you’re left with only $100,000.

Don’t be that guy.

The key to winning in crypto isn’t just about picking the right assets; it’s about knowing when to secure profits.

Let’s break down how to take profits effectively, avoid emotional decision-making, and ensure that you never walk away empty-handed.

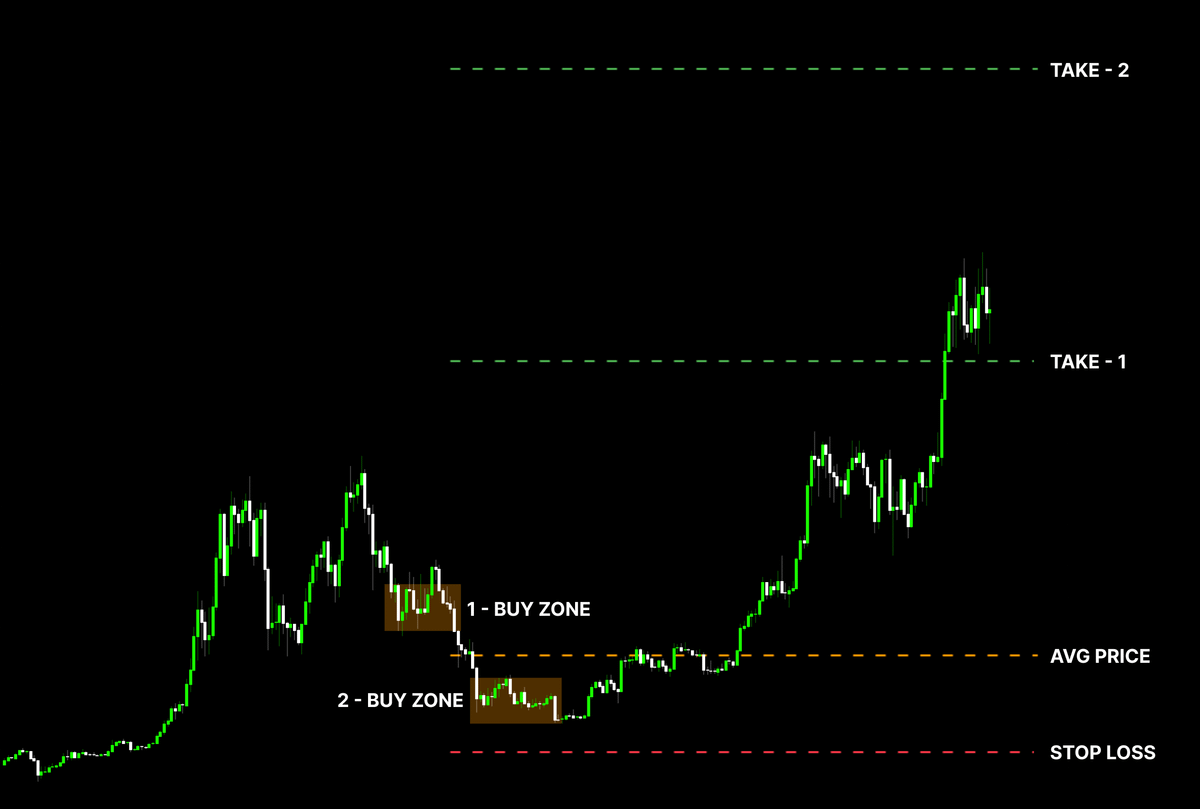

1: Have a Plan for Every Position

Before entering any trade, you need a clear strategy. This means knowing:

Your buy zones — Where you’re comfortable entering a trade

Your take-profit levels — Where you’ll start locking in gains

Your stop-loss or invalidation point — When to cut losses and move on

A structured plan removes emotional decision-making and prepares you for any market move. Ask yourself:

What if price skyrockets? Have pre-set take-profit levels.

What if price tanks? Decide whether you’ll cut losses or dollar-cost average (DCA).

What if price moves sideways? Have a strategy for accumulation.

By thinking through different scenarios in advance, you ensure that your moves are calculated — not reactions based on fear or greed.

2: Avoid Common Psychological Traps

Even experienced traders fall into emotional traps when they lack a plan. The two biggest ones?

Fear — Selling too soon after a small gain, only to watch the asset 10x afterward.

Greed — Holding indefinitely, convinced the price will go higher, only to see it crash back to your entry — or worse.

The solution? Systematic Profit-Taking.

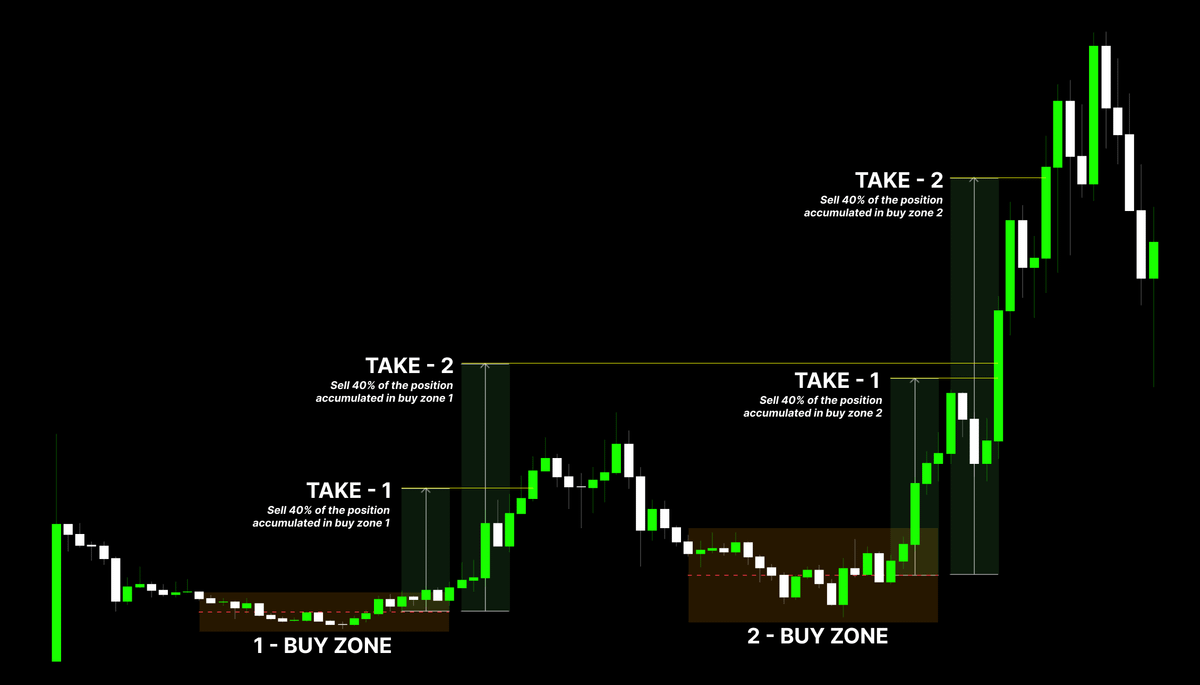

3: The Target-Based Profit-Taking Strategy

A systematic approach to profit-taking ensures you lock in gains while keeping exposure to further upside. Here’s how it works:

Target 1: When the asset reaches 3x your entry price, sell 40% of your position. This secures your initial investment and some profit.

Target 2: At 5x, sell another 40%, locking in additional gains.

Final Target: The remaining 20% stays as a moonbag — meaning you hold it indefinitely, risk-free.

This strategy guarantees that even if the market turns bearish, you’ve already secured at least 3.2x your initial investment. No regrets.

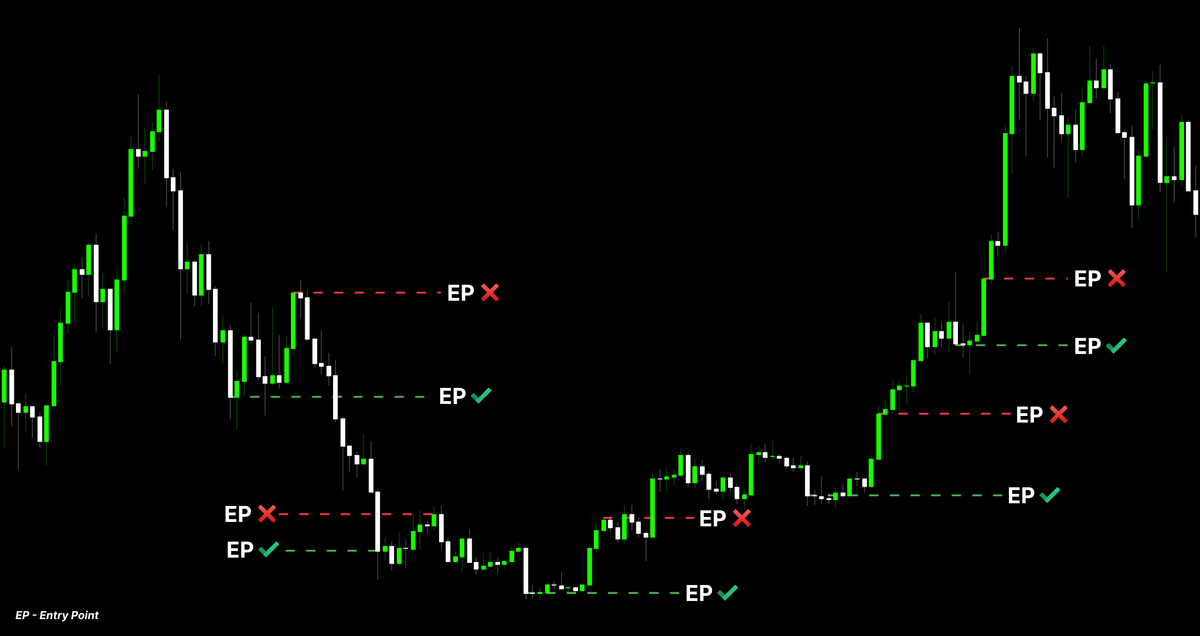

4: Perfecting Entry Points

A good entry is just as important as a good exit. Here’s how to ensure you enter at the right time:

DCA (Dollar-Cost Averaging): Instead of going all-in at once, build your position gradually. This reduces risk and improves your average entry price.

Buy the Dip: Only buy during corrections or accumulation phases — never during pumps. This prevents emotional FOMO buys and maximizes your risk-reward ratio.

A smart entry strategy means you’re never overexposed at market peaks.

5: Risk Management & Adaptation

The market is unpredictable, so while your core strategy remains, your execution should remain flexible. Here’s how to manage risk effectively:

Predefined Risk Per Trade: Never risk more than a set percentage of your portfolio on a single trade.

Stop-Loss Discipline: If an asset invalidates your thesis, exit and move on — don’t bag-hold in hopes of a miracle.

Adaptability ensures that when the market shifts, you’re not caught off guard.

Final Thoughts: Stay in Control

A structured plan reduces emotional mistakes.

Profit-taking prevents fear and greed from dictating your trades.

Smart entries improve win rates and risk management.

This system can be adapted for different assets and market cycles, but the core principles remain the same: Secure profits, manage risk, and stay in control.

One final note: This strategy doesn’t always apply to low-cap AI coins, memes, or ultra-volatile assets. The structure remains, but targets must be adjusted based on risk tolerance.

At the end of the day, your goal is not to make the perfect trade it’s to walk away profitable.