- NEXTBULL Masterclass

- Posts

- Strategic Bitcoin Reserves: A Visionary Concept or Political Posturing?

Strategic Bitcoin Reserves: A Visionary Concept or Political Posturing?

Imagine a future where nations no longer rely solely on gold or oil as strategic assets but turn to Bitcoin, the crown jewel of digital finance.

The very idea of a country establishing a strategic Bitcoin reserve might have seemed outlandish a decade ago.

Yet today, it’s not only a topic of serious discussion but also a campaign promise by none other than Donald Trump, now serving his second term as President of the United States.

But what does this vision entail?

Can Bitcoin really step up as a safeguard for economic stability, and will this ignite a global race among nations to hoard the world’s most famous cryptocurrency?

Bitcoin

What’s a Strategic Bitcoin Reserve, Anyway?

Think of it as the digital era’s answer to the resource stockpiles of the 20th century. Back in the 1970s, the U.S. established the Strategic Petroleum Reserve, filling underground caverns with millions of barrels of oil to shield the economy against supply shocks.

Fast forward to today, and some argue that Bitcoin could play a similar role — acting as a hedge against inflation, economic instability, and the declining dominance of the U.S. dollar.

The logic is simple: Bitcoin, often called “digital gold,” offers scarcity, transparency, and resilience against political meddling.

Digital gold

With the U.S. already holding over 8,000 tonnes of gold as a buffer against market volatility, Bitcoin could complement these reserves, providing a modern twist to an age-old strategy.

What Could a Bitcoin Reserve Look Like?

Currently, the U.S. government owns roughly 200,000 BTC, seized from illicit activities over the years.

Unfortunately, rather than holding onto this cryptocurrency, Uncle Sam has auctioned most of it off, losing out on billions in potential profits.

Trump’s idea?

Use this existing stash as the seed for a national Bitcoin reserve. However, the mechanics of such a move remain murky, with legal questions about transferring control from the Department of Justice to a dedicated reserve.

Interestingly, some lawmakers are eager to take this even further. Wyoming Senator Cynthia Lummis, a long-time Bitcoin advocate, introduced the BITCOIN Act, proposing that the U.S. acquire a staggering 1 million BTC over five years.

BTC reserve

If implemented, this would represent 5% of Bitcoin’s total supply, a figure that could cost $100 billion if Bitcoin reaches $100,000 per coin.

The act also outlines strict rules for holding this reserve for 20 years, with provisions to sell it only to reduce federal debt.

While Trump hasn’t committed to such an ambitious target, his stance signals an eagerness to position the U.S. as a leader in the crypto space, especially in the face of growing competition from nations like China.

Ripple Effects on Bitcoin’s Value

The mere prospect of the U.S. establishing a Bitcoin reserve has already sent ripples through the crypto market.

Bitcoin enthusiasts can’t help but dream of astronomical price surges, fueled by insatiable institutional demand and a growing appetite for digital assets.

Following Trump’s election victory, Bitcoin breached the six-figure mark for the first time, buoyed by speculation around government involvement.

Industry experts predict that such a move could push Bitcoin’s price to unprecedented levels.

BTC’s value

Samson Mow, CEO of JAN3 and a key player in El Salvador’s Bitcoin strategy, envisions Bitcoin reaching as high as $1 million, particularly as nation-states deepen their investments not just for reserves but for leveraging Bitcoin in energy production and economic sovereignty.

However, skeptics caution against over-reliance on Bitcoin to solve America’s financial challenges.

With national debt soaring past $35 trillion, some question whether even Bitcoin’s bullish momentum can counteract such monumental liabilities.

Political and Practical Challenges

As bold as this vision sounds, realizing it is no small feat. Trump’s presidency is fraught with challenges, from geopolitical tensions to domestic crises.

The razor-thin Republican majority in Congress also complicates matters, leaving limited room to push through controversial policies.

BitMEX co-founder Arthur Hayes warned that Trump might have just one year to implement his most ambitious ideas before political headwinds intensify.

Arthur Hayes

Moreover, Bitcoin’s foundational philosophy — distrust of centralized authorities — raises a philosophical conundrum.

Would Satoshi Nakamoto, Bitcoin’s elusive creator, have envisioned governments becoming dominant holders of this decentralized asset?

Could Other Nations Join the Fray?

The idea of a U.S. Bitcoin reserve has already inspired chatter among other countries.

Canada’s opposition leader Pierre Poilievre, a long-time Bitcoin proponent, might pursue a similar strategy if he wins the upcoming election.

Meanwhile, lawmakers in Germany, Hong Kong, and beyond are advocating for their governments to explore Bitcoin stockpiling.

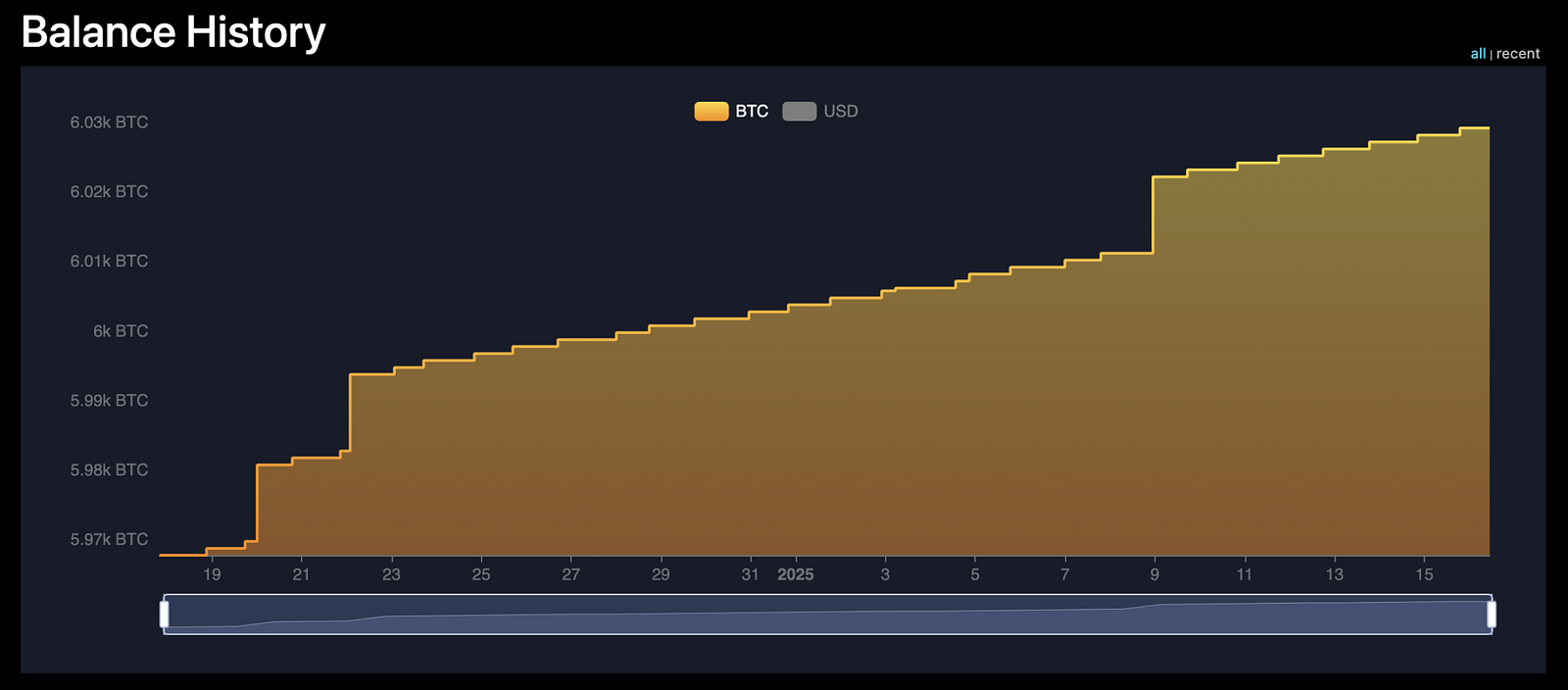

El Salvador, the pioneer in adopting Bitcoin as legal tender, could arguably be seen as having the first strategic reserve, given its consistent purchases of 1 BTC daily.

The country’s bold approach has yielded hundreds of millions in paper profits, further cementing its reputation as a trailblazer in Bitcoin adoption.

Changpeng Zhao, the former Binance CEO, summed it up best at the Bitcoin Middle East and North Africa conference:

“The nations that embrace Bitcoin now will lead the world in the digital economy of tomorrow.”

El Salvador’s Bitcoin reserves

A Vision Worth Pursuing?

The idea of a strategic Bitcoin reserve presents an intriguing crossroads for modern economies.

On one hand, it represents a forward-thinking approach to financial resilience and technological leadership. On the other, it’s fraught with risks, political hurdles, and philosophical debates about Bitcoin’s true purpose.

Whether Trump delivers on this promise or not, the mere discussion has already shifted the global narrative.

Bitcoin is no longer just an investment; it’s a geopolitical tool, a symbol of sovereignty, and potentially, the digital backbone of future economies.

The question is not if, but when, the world will fully embrace this new era.