- NEXTBULL Masterclass

- Posts

- Mastering Market Flow: The Step-by-Step Trading Blueprint for Beginners

Mastering Market Flow: The Step-by-Step Trading Blueprint for Beginners

Every beginner in trading starts with the same question: Where do I even begin? The charts, the candles, the endless coins, it all feels overwhelming at first.

But trading doesn’t have to be chaotic. The key lies in following a dynamic, step-by-step approach that adapts to both the market and your mindset.

Let’s break down the Dynamic Rule of Trading, a framework designed to help new traders think clearly, act with purpose, and build consistency over time.

Crypto Trader

Step 1: Coin Selection

Not every coin will suit your trading style. Some move too slow, others move too wild. The first rule is to filter. Stick to coins that fit your trading plan whether that’s scalping fast movers or holding steady performers.

Step 2: Liquidity and Volatility

Your strategy dictates what kind of market conditions you need. If you’re a scalper or day trader, volatility is your playground without it, there’s no movement to profit from. For swing or long-term traders, liquidity matters more. A coin that’s too volatile can shake you out before the bigger move happens.

Step 3: Chart Selection

For short-term trading, pick coins that are both liquid and volatile. These offer enough price movement for entries and exits without slipping through illiquid order books.

Step 4: Time Frames

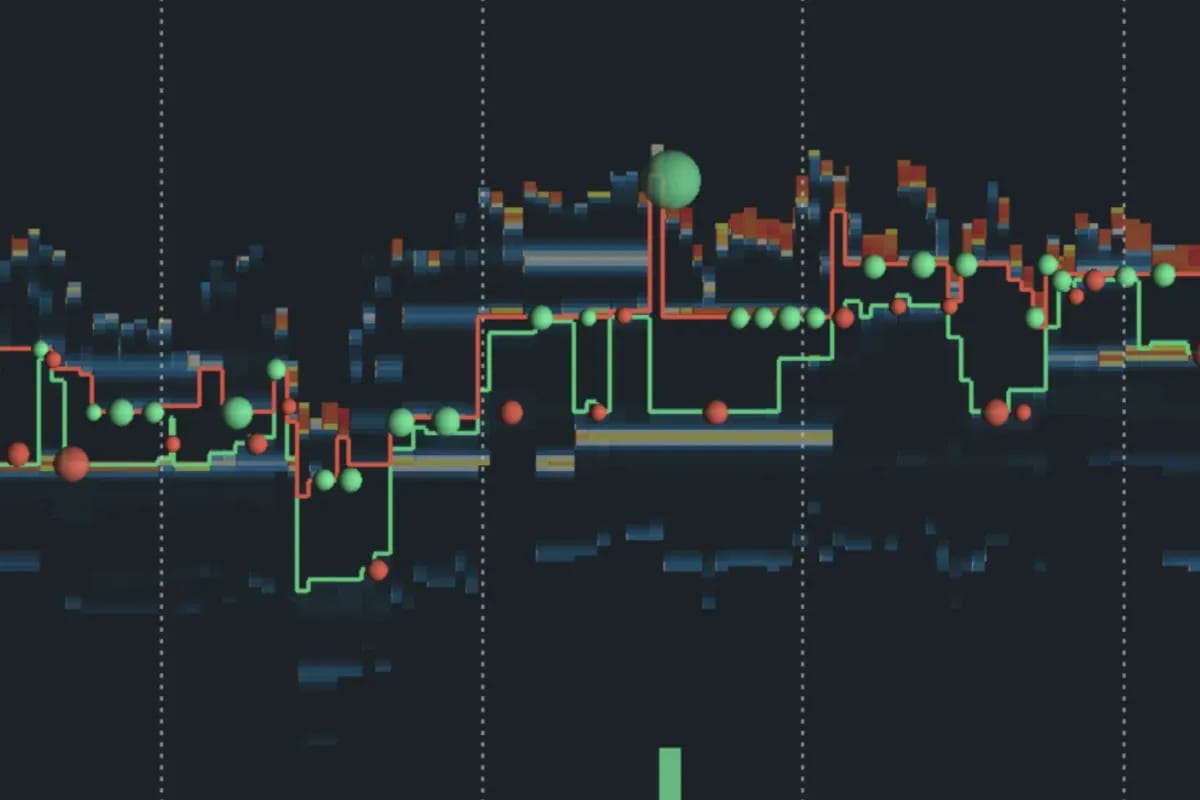

Start with the 15-minute chart to spot key support and resistance zones. Once a coin begins consolidating, zoom in to the 5-minute chart for precise entry. Need sharper accuracy? Drop to 3-minute. A setup that aligns across these time frames is usually a high-probability trade.

Step 5: The Time Difference Rule

This is a pro trick many beginners overlook. If you’re analyzing a 1-hour chart, enter using the 15-minute, roughly one-fourth of your main time frame. If the entry’s still unclear, drop it to 5 minutes. Once your trade is live, manage it back on the higher time frame. When you reach a 1:1 risk-reward ratio, close half your position, protect your gains and let the rest run.

Step 6: Bias and Flexibility

Have a bias but don’t marry it. A trader without conviction hesitates, but a trader who refuses to adapt breaks fast. Stay flexible; the market owes you nothing.

Step 7: Mindset and Discipline

The best traders know when to stop. If you’ve booked 40–60% profit or nailed three to four good trades in a day, walk away. Overtrading kills focus faster than losses do.

Step 8: Focus on Quality Setups

Experience will refine your edge, but for now, prioritize clean setups near recent support and resistance levels. Trade only what’s clear confusion costs money.

Step 9: Order Blocks

Watch where the market makes its most aggressive moves. These “order blocks” show where major players stepped in. If price pumps from a low, that’s a bullish order block; if it dumps from a high, it’s bearish. Trade in harmony with the overall market sentiment.

Final Step: Execution

All the planning in the world means nothing without action. Great setups are wasted by hesitation. Test across time frames, confirm your bias, and execute with confidence.

Because in trading, the difference between theory and success is simple execution.