- NEXTBULL Masterclass

- Posts

- How to Make Life-Changing Gains by Buying the Dip

How to Make Life-Changing Gains by Buying the Dip

The crypto bull run is in full swing, and with it comes a golden opportunity to build wealth — but only if you know how to play the game.

The dip may seem like a moment of panic for many, but for the savvy investor, it’s the perfect chance to buy low and ride the wave to incredible gains.

If you’re ready to stop guessing and start winning, here’s how to take advantage of this bull run and set yourself up for success.

The Dip

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

The Chaos of Bull Market Dips

Bull markets are thrilling, but they come with their own set of challenges. CEX crashes, mass liquidations, and panic sell-offs are common during dips.

As prices fall, people start calling the top prematurely, terrified that they’ve missed their chance to ride the wave.

The problem is, most people end up buying high and selling low, chasing a fleeting moment of hope.

If you want to be among the few who capitalize on this dip, you need a strategy. The dip isn’t a time to panic — it’s your opportunity to pounce.

Marking Key Macro Levels

Step one: mark key macro levels on higher timeframes, especially for Bitcoin (BTC). This is your roadmap for identifying support levels if prices begin to dip.

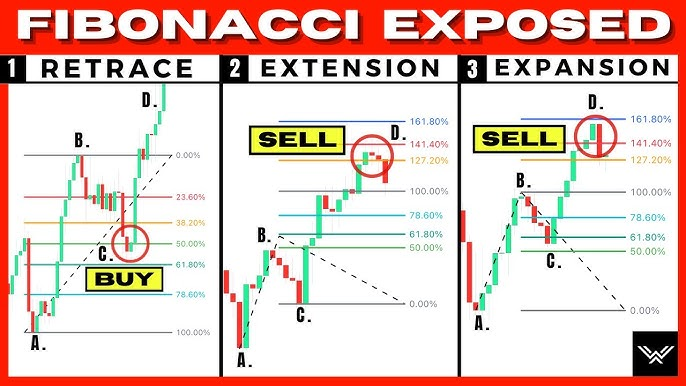

Look at the weekly (1W) BTC chart and use moving averages and Fibonacci levels to get a more accurate picture.

For example, in the last cycle, BTC’s All-Time High (ATH) aligned perfectly with the 0.5 Fibonacci retracement level on its current pump. That means if BTC dips into a similar zone again, you can confidently buy the dip.

By setting these key levels, you’ll know exactly when it’s time to buy.

Fibonacci levels

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

How Do You Know When to Buy?

Here’s the key to successfully buying the dip: mean reversion strategy. It’s simple yet powerful:

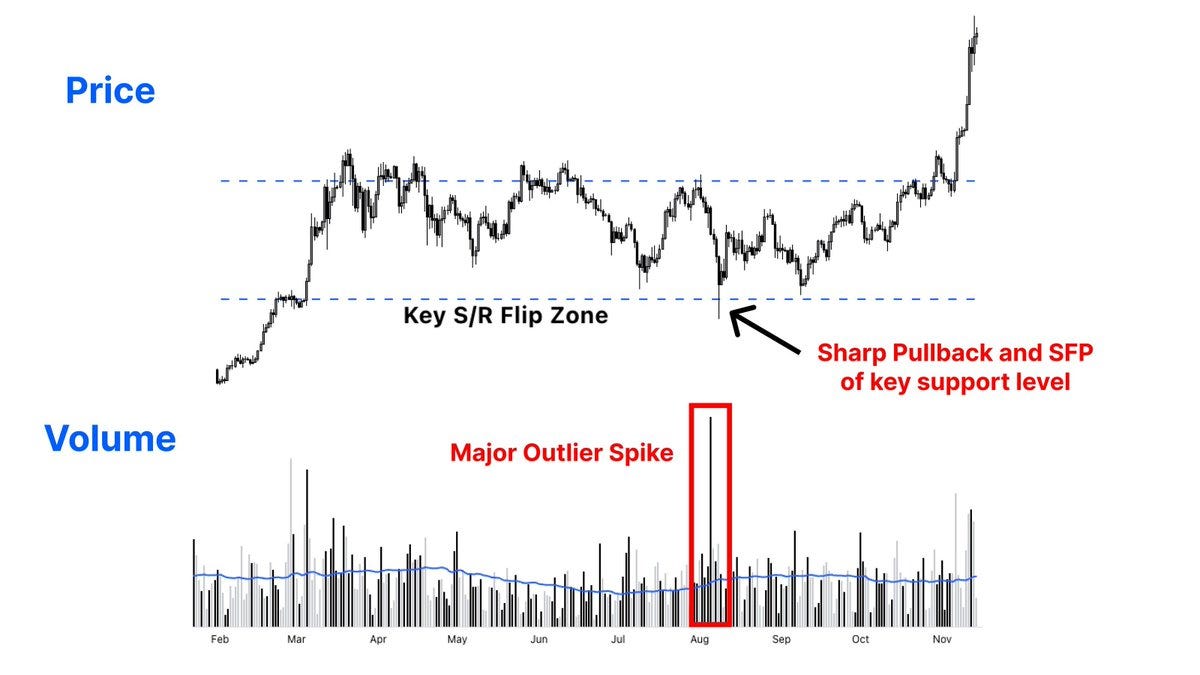

Spot a steep pullback into a support zone.

Look for a massive volume spike signaling sell exhaustion.

Once the price reclaims the support level, go long, or set a limit buy order.

A perfect example of this came in August, when BTC dropped by 30% into a critical support/resistance level.

The massive volume spike after the dip confirmed sell exhaustion, making it the ideal moment to go long.

This setup was the beginning of a massive price reversal — and similar opportunities will show up again.

Price drop

What Should You Buy During a Dip?

It’s time to get strategic. The first thing you should always buy is Bitcoin (BTC), as it’s the king of the market. When BTC rallies to new highs, it lifts the entire market with it.

However, altcoins that have shown resilience during previous pullbacks are your secondary target.

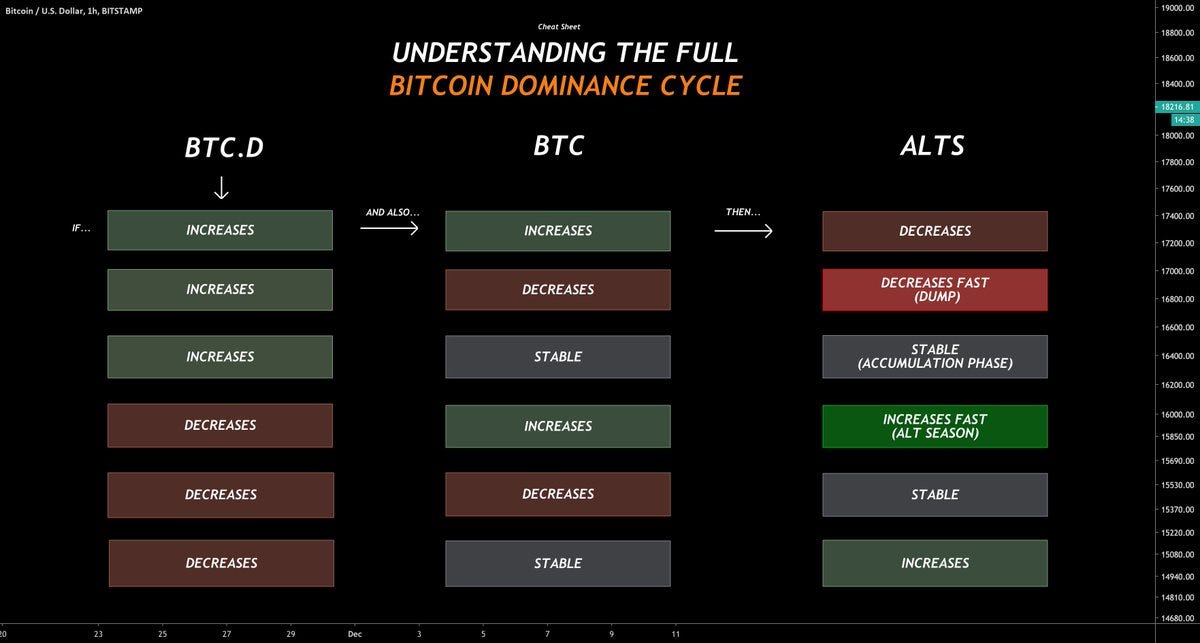

Look for strong performers like $SOL, $WIF, and $PEPE, especially when BTC dominance drops, signaling that money is flowing into altcoins.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

BTC dominance cycle

How to Tell When a Dip is Coming

Here’s the brutal truth: you can’t always predict when a dip will happen. The market doesn’t wait for you to be ready, but the great news is, dips are almost guaranteed.

So, you can prepare. It’s about getting ready for the inevitable and positioning yourself for success.

One of the biggest regrets in a bull market is not taking profits when the opportunity arises.

You won’t be able to time the top perfectly, so get comfortable missing out on a bit of extra gain. It’s better to take profits early than wait too long and get caught in the downturn.

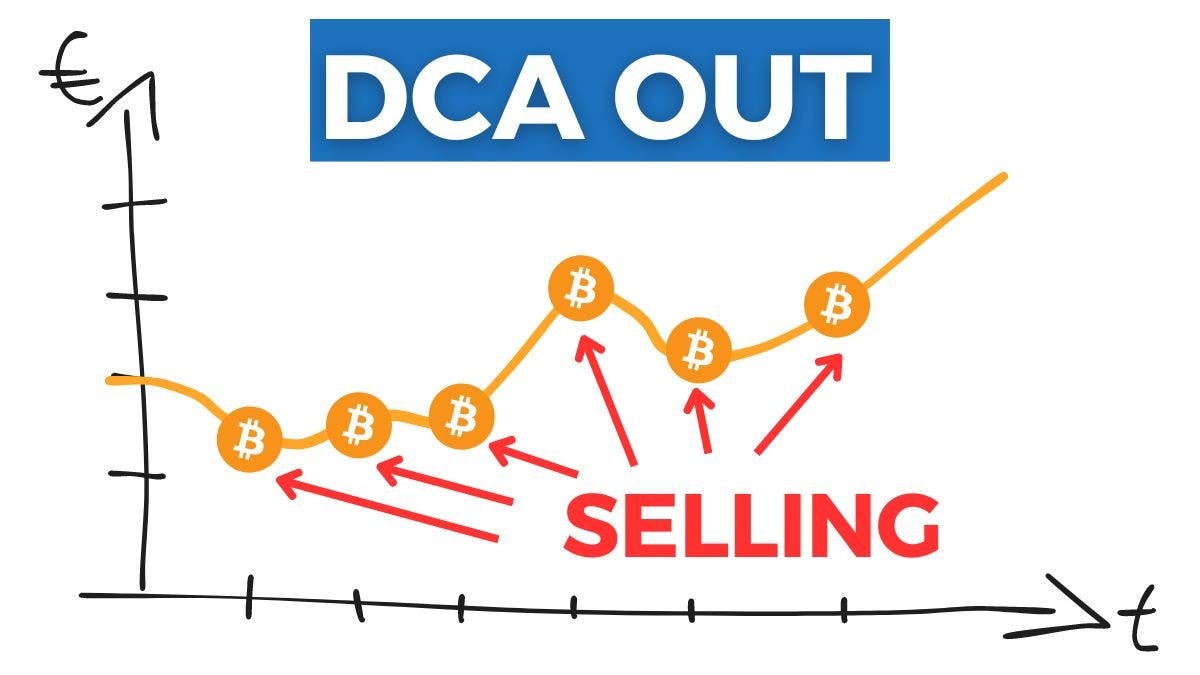

You can Dollar-Cost-Average (DCA) out, meaning you always have cash ready to buy the dip when it comes. But more importantly, have a plan.

Decide ahead of time how much of your profits you’ll take off the table and how much you’ll use to buy the next dip.

This way, when the market starts moving quickly, you won’t be caught up in the FOMO.

DCA

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Be Patient and Stay Calm

Timing the top is tough — but timing the dip is just as difficult. However, patience pays off. As long as we’re in a bull market, the dips are more likely to bounce back.

Don’t let short-term volatility shake you out. Stay patient, and remember — everything will likely be pumping again soon enough.

Reduce Exposure Gradually

As the market gets more volatile, you need to reduce your exposure strategically.

Each dip on BTC signals weakening momentum, and while you can still buy, don’t go all-in.

The last thing you want is to bet everything on the final dip, only for it to mark the start of a bear market. Stay cautious and keep your eyes open for early warning signs.

The Biggest Mistake: Guesswork

The worst mistake you can make in this bull market is to move based on guesswork. Don’t let fear or greed dictate your moves.

Instead, study the market and use the information at hand to guide your decisions. This is how you build wealth during a bull market — with knowledge, patience, and a solid strategy.

Don’t Miss Out

This is the time to act, but it’s crucial to have a plan. The bull run is just getting started, and the opportunities are endless.

By buying the dips, knowing when to take profits, and reducing your exposure at the right time, you can maximize your gains and build real wealth.

So, what’s your plan? The next few months could make or break your future. The question is: Are you ready to take the leap, or will you be the one left holding the bag? The bull run is here, and the choice is yours.

Enjoyed this read? Join 5,211+ crypto enthusiasts in our email newsletter and level up your crypto game! Don’t forget to clap if you want more content like this!