- NEXTBULL Masterclass

- Posts

- How Crypto Outflows Are Setting the Stage for Explosive Gains

How Crypto Outflows Are Setting the Stage for Explosive Gains

The world of cryptocurrency is buzzing with a strange energy. Prices are climbing, excitement is building, and yet, something far more significant is happening beneath the surface.

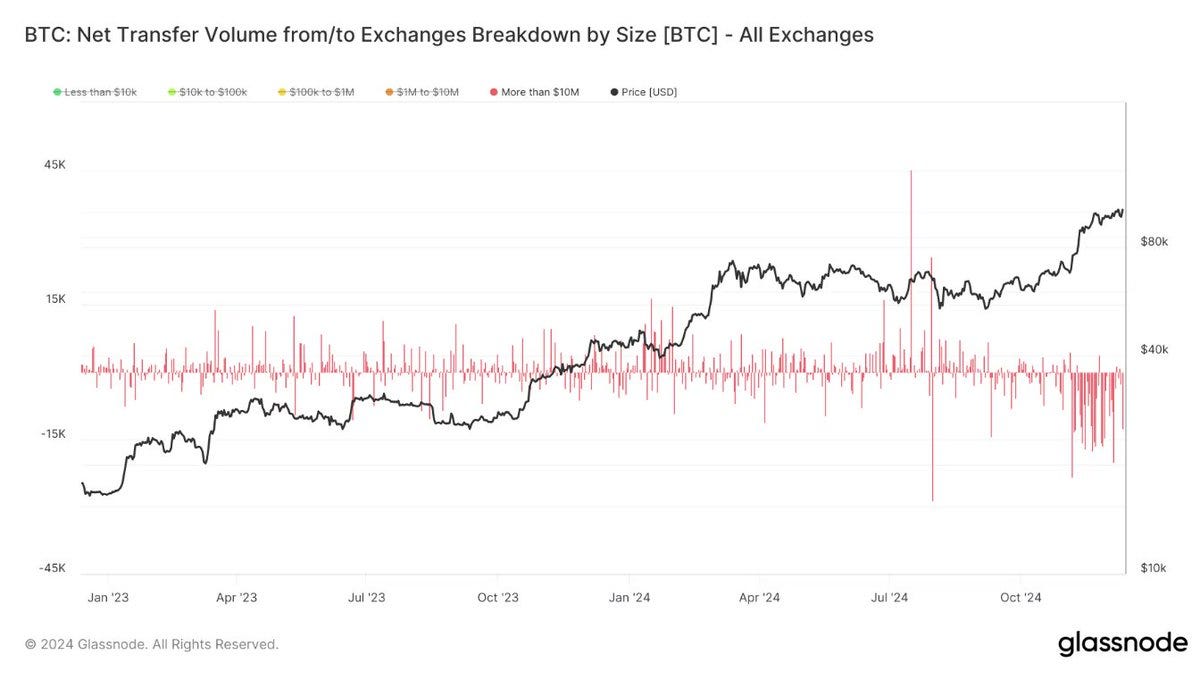

Centralized exchanges, the main hubs where most crypto transactions occur, are witnessing the largest outflow of assets in history.

A shift of this magnitude has happened before — in 2018 and 2021 — and both times, it led to explosive bull runs.

So, what does this mean for you? And why should you pay attention? Let’s break it down.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

The Calm Before the Storm

Picture this: You’re watching the crypto market, prices rising steadily, and everything seems to be moving as expected.

Then, out of nowhere, a massive shift occurs — Bitcoin and other cryptocurrencies are leaving exchanges at record rates. This isn’t a glitch or a coincidence.

It’s a signal. If you understand what this means, you’re ahead of 99% of traders. And it’s a signal you don’t want to miss.

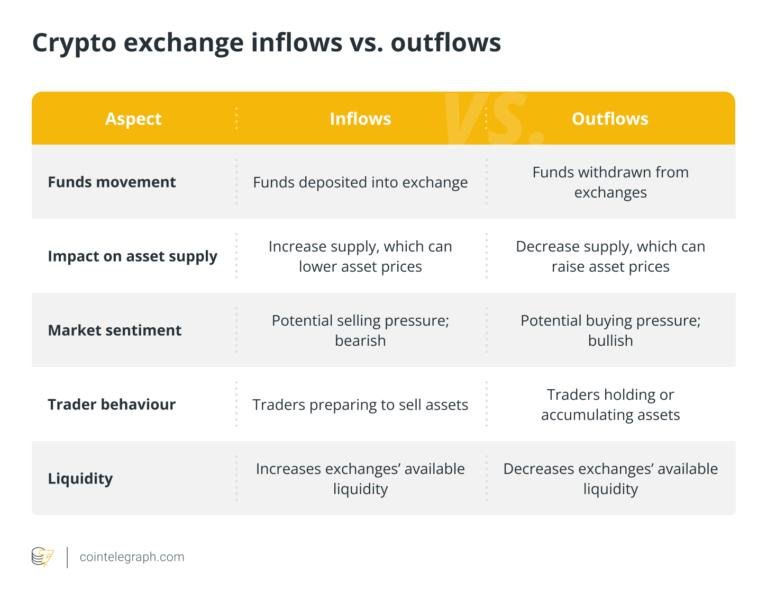

Inflows vs. Outflows: What They Really Mean

In the world of crypto, there are two critical terms that every trader needs to know: inflows and outflows.

Inflows refer to crypto moving into exchanges, often because investors want to sell.

Outflows are when crypto moves out of exchanges, usually to cold storage, indicating that the investor plans to hold rather than sell.

It’s simple supply and demand economics, but with crypto, these movements are often more extreme and faster-paced than traditional markets.

Right now, what’s happening is wild — and it’s crucial to understand.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Inflows Vs Outflows

The Historic Outflow Trend

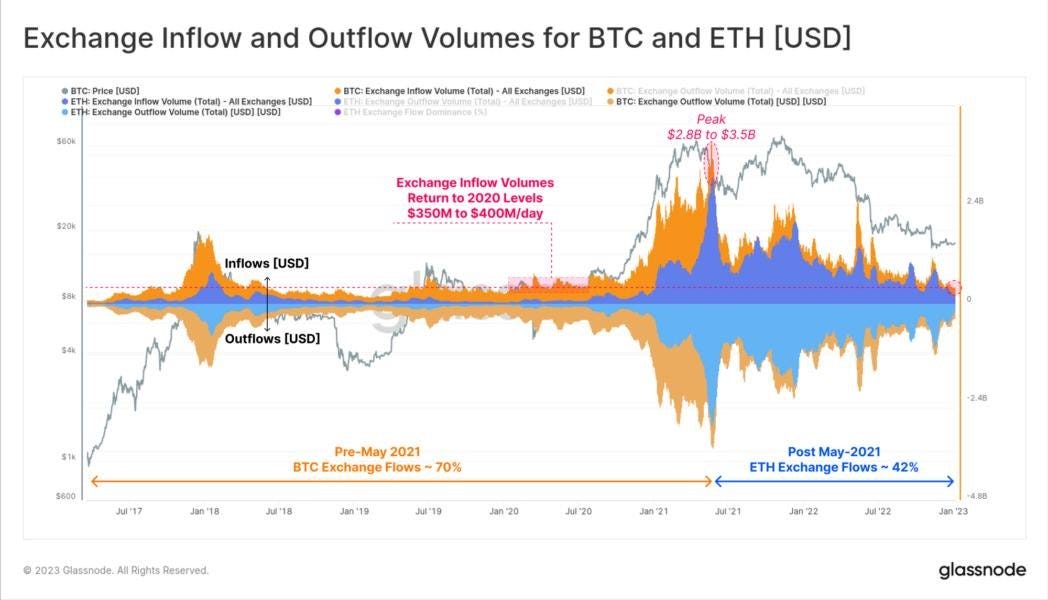

In 2024, something huge is happening. Outflows from centralized exchanges have reached record highs — the largest in history. This is not the first time we’ve seen this trend.

In 2018 and again in 2021, massive outflows preceded some of the most explosive bull runs we’ve ever seen.

The market is acting the same way it did before those massive price surges. If history is any indicator, we could be on the verge of something massive.

So, why do outflows matter so much? Think of it like a store running low on inventory. If a store has fewer goods on its shelves but demand stays the same, what happens? Prices go up.

It’s Economics 101, but with crypto, the effects are amplified. When the supply of available crypto decreases, and demand increases, the price has no choice but to rise.

What Are They Holding? Why Are They Pulling Back?

When investors, especially whales and institutions, start pulling their crypto off exchanges, it’s not because they’re planning to sell.

They’re planning to hold — they believe prices are about to explode, and they’re positioning themselves for the next big wave.

By moving their assets into cold storage or long-term holdings, they’re essentially saying, “I’m not selling. I’m waiting for something big.”

This behavior signals confidence in the market, and it’s a sign that bullish times are ahead.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Understanding the Full Picture: What About Inflows?

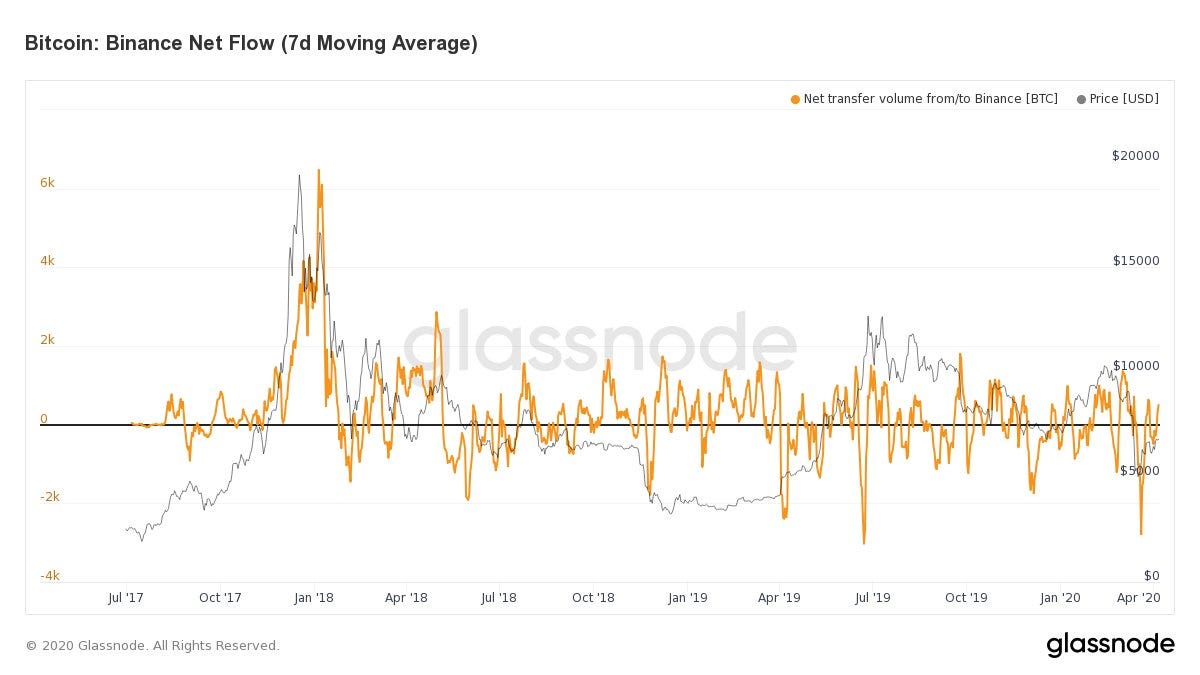

While outflows are the key signal here, inflows tell a different story. When Bitcoin (BTC) starts flooding exchanges, it often means investors are preparing to sell.

These inflows are typically associated with fear in the market — people rushing to liquidate their positions before prices drop. In short, large inflows usually precede a market dump.

The key to predicting the market’s next move is reading the behavior of the market.

Right now, the combination of massive outflows and no negative news suggests something huge is brewing. It’s a perfect setup for a bull run. No panic, just confidence.

The Setup for the Biggest Bull Run Yet

As outflows continue to spike, whales and institutions are quietly removing their crypto from exchanges, positioning themselves for the next big wave.

The market is reducing its supply of crypto, and demand is poised to surge — global adoption, ETFs, and growing investor interest are all lining up to fuel this.

This setup is exactly how explosive bull markets begin. And while the market whispers its intentions, if you know how to listen, you’ll hear the signs before they become clear to everyone else.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

How to Spot the Moves Before They Happen

The best traders don’t wait for the market to shout its intentions. They listen to the whispers — the outflows, inflows, and on-chain data — to get ahead of the curve.

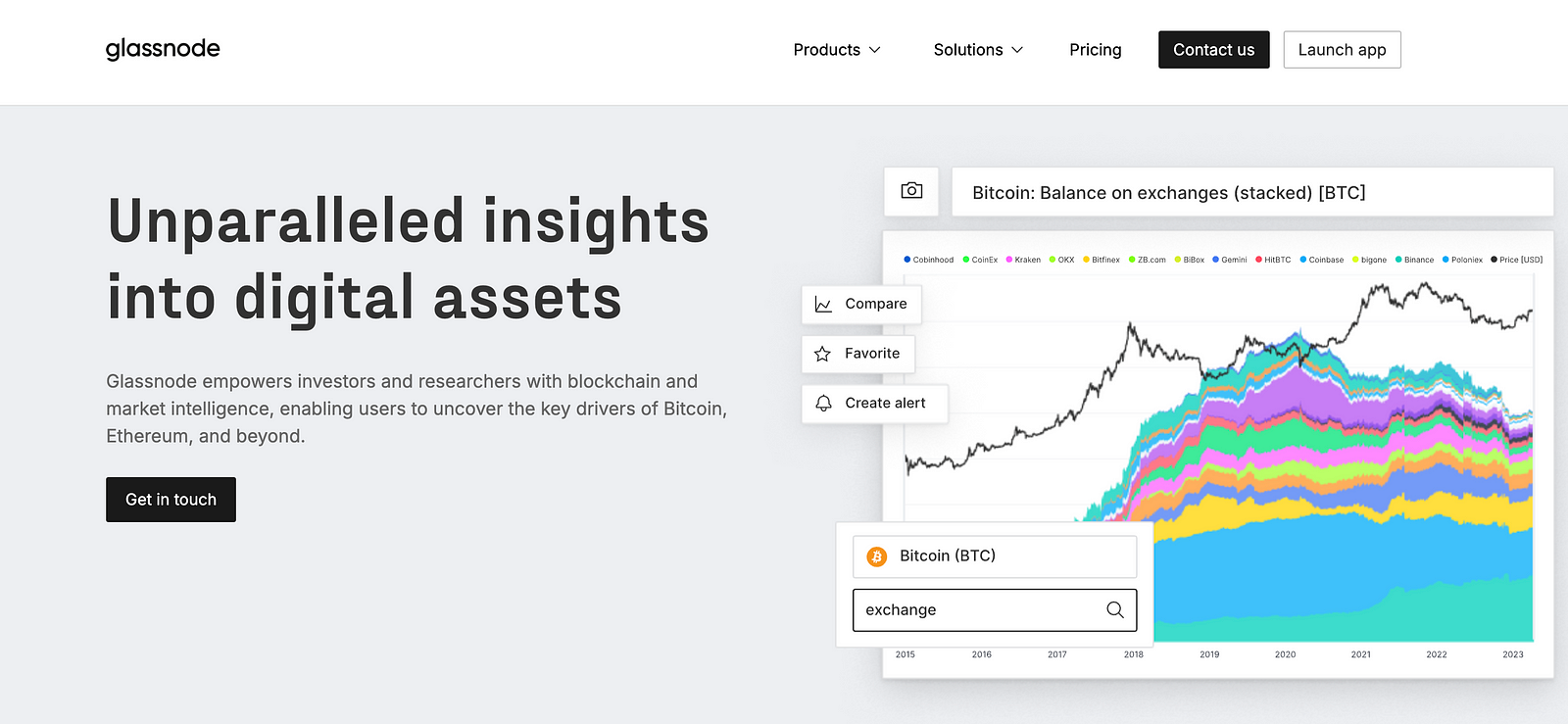

To do that, you need the right tools. Here are three platforms pros use to track these movements and predict market shifts before they happen:

Glassnode — glassnode.com

CryptoQuant — cryptoquant.com

These tools give you real-time insights into crypto movements on exchanges. If you know how to read them, you can see the trends before they become obvious to everyone else.

Glassnode

The Bottom Line: Get Ready for the Ride

The largest crypto outflow in history is happening right now, and the market is quietly setting up for what could be one of the biggest bull runs in history.

With demand increasing and supply dropping, the stars are aligning. The whales are making their moves — are you ready to follow suit?

The market doesn’t scream its intentions. It whispers. And if you know how to listen, you’ll be in the perfect position to capitalize on the next massive wave.

Keep your eyes on the outflows, and prepare for what’s coming next — because this ride is just getting started.

Enjoyed this read? Join 5,211+ crypto enthusiasts in our email newsletter and level up your crypto game! Don’t forget to clap if you want more content like this!