- NEXTBULL Masterclass

- Posts

- How Buying a Username Made Me Believe in TON

How Buying a Username Made Me Believe in TON

I first heard about Toncoin in early 2022. I was skeptical: crypto noise was everywhere, and many promising projects disappeared as fast as they showed up.

But something about TON felt different! Telegram, its huge user base, the ease of sending crypto through chats, all of that whispered potential. So I took a small stake, not all in, but enough that it would hurt if it crashed. My gut said: this may be cheap now, but if it delivers, the payoff could surprise me.

One of the early gambles was the inclusion of the @wallet bot in Telegram, which meant I could send Toncoin simply using the app’s chat interface. No extra apps, no painful copy-pasted addresses, transaction fees were minimal. Now around May 2022, I remember that feature being upgraded and it felt almost too easy: I bought Toncoin using a credit card inside Telegram, then sent it to a friend just by picking their Telegram handle like sending a message. That broke down a lot of psychological barriers for me.

Telegram Wallet Bot

Then came domain auctions. In mid-2022, Toncoin launched TON DNS and the ".ton" naming system, letting users bid for human-readable domains in an on-chain way. Suddenly digital identity, something that felt abstract, had a place in the TON world. Also, Toncoin got listed on more exchanges that year: in September 2022 it was getting listed on Huobi Global, and later on LBank. Those listings brought more eyes, more liquidity, more chatter. But with that excitement came second-guessing: was this just hype riding Telegram’s shadow?

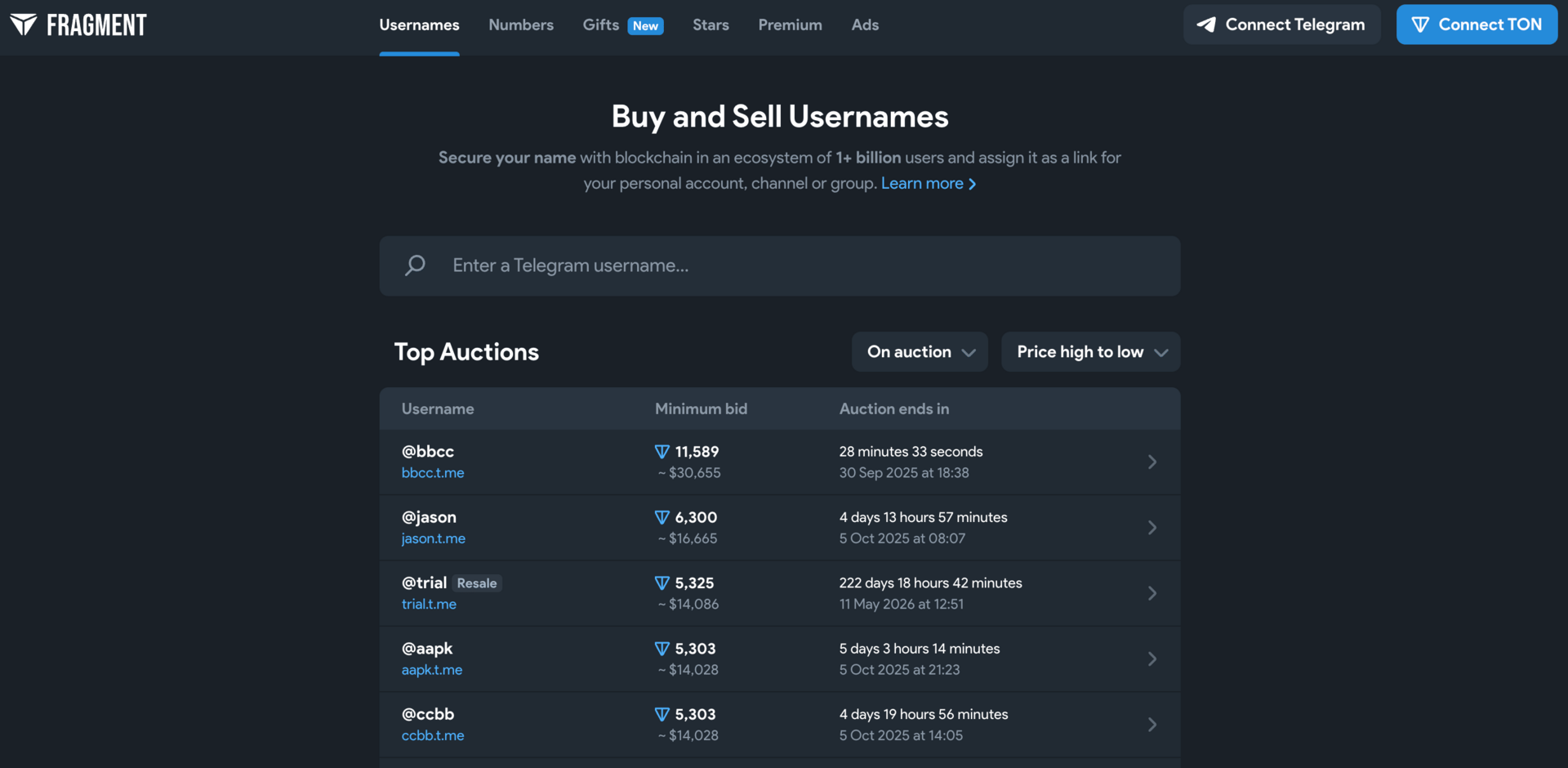

Late 2022 had a moment that still makes my heart race: Telegram started selling handles (usernames) via auctions on Fragment.com and required Toncoin for that. That move was small on the grand scale, but for me it was loud: here was utility, something people might pay for even if they don’t believe in crypto. A username is vanity, yes, but if people are burning Toncoin just for handles, that’s demand in peer-to-peer form.

Fragment.com

I watched my small position wobble. Sometimes Toncoin would spike after a listing or an announcement, only to fall back when markets turned sloppy. I felt déjà vu: this is what I’d seen in too many altcoins before. At nights I worried I’d lose more than I gained. Would transaction volume ever scale? Would Telegram ever lean fully into TON rather than keep it in peripheral sandbox mode?

Then something shifted. In early 2023 and 2024 TON began adding more functionality: stablecoins like USDT issuing on TON, Telegram’s ad revenue sharing via the TON blockchain, better integration of mini-apps. But looking back to 2022, I see that the groundwork laid that year, the ease of sending through @wallet, the aesthetic appeal of owning a .ton name, the excitement of listings those were signals. I held. Because I had seen noses turn up at utility before, but this felt more than trend-chasing; it felt foundational.

What I learned: utility matters more than hype; small signals of adoption (a bot upgrade, a domain, listings) often set the stage for bigger structural shifts. Also, holding through doubt is grueling, but it teaches you to see long game rather than short wins. And finally, integration with a real user base (Telegram in this case) can turn optional crypto features into something people want just because it's easy and useful, not because they believe in the brand.

If I could tell my 2022 self anything, it’d be: trust more quietly, but don’t bail just because the mood sours. What seems like vanity (usernames, easy transfers) often becomes the bridge to real demand.

If you enjoyed this article, be sure to like and follow for more crypto related articles.