- NEXTBULL Masterclass

- Posts

- Bitcoin Demand Hits 3-Year High: Next Bull Run Around the Corner?

Bitcoin Demand Hits 3-Year High: Next Bull Run Around the Corner?

Bitcoin is back in the spotlight, breaking records and igniting market excitement.

Earlier this week, the crypto giant surged to a staggering all-time high of $108,000, only to experience a pullback below $96,000 shortly after.

While some may view this dip as a setback, it mirrors trends seen during historic bull runs. Is Bitcoin gearing up for another explosive rally?

Let’s dive into the metrics and patterns that hint at what’s next for the world’s leading cryptocurrency.

Bitcoin

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Bitcoin’s Changing Hands: A Familiar Cycle

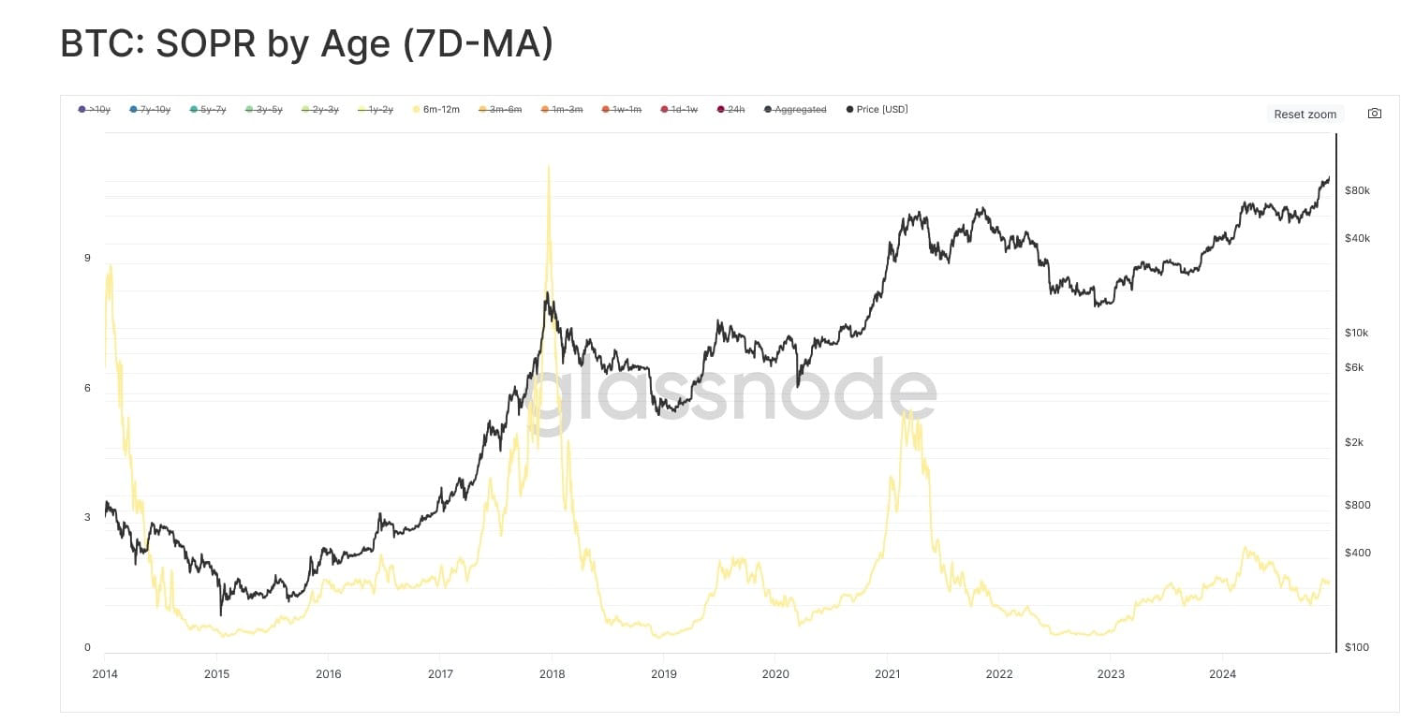

Bitcoin’s current price action is being driven by mid-term holders — those who have held BTC for six to twelve months.

These investors, who accumulated during previous market cycles, are now cashing in on profits as prices surge.

This behavior closely resembles the 2015–2018 bull market, where the Spent Output Profit Ratio (SOPR) stayed below 2.5 before a euphoric rally took Bitcoin to new heights.

The SOPR measures the profitability of coins being spent, offering insights into market sentiment.

Heavy profit-taking is typical during bull runs but often leads to a phase of exhaustion.

For Bitcoin to sustain its upward trajectory, fresh demand from new buyers is essential. Without this influx of capital, the rally could lose steam.

BTC: SOPR

Rising Demand Signals Renewed Interest

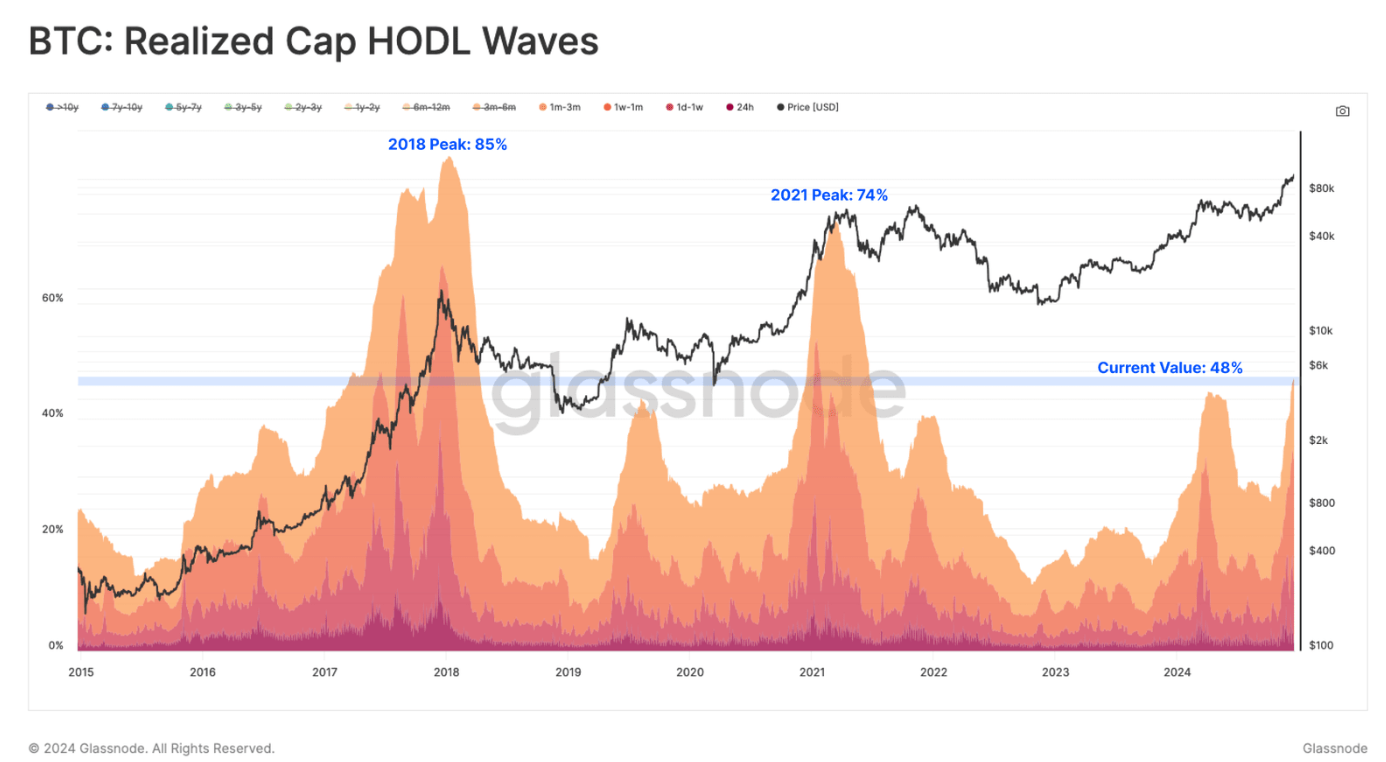

Data from Glassnode’s HODL Waves reveals an increase in the amount of Bitcoin held by new buyers.

Coins previously held by long-term investors are now being redistributed, indicating that fresh capital is entering the market.

This shift underscores growing demand, even amid recent price fluctuations.

However, the proportion of wealth held by newer investors has yet to reach the levels seen during the peaks of prior all-time high cycles.

For Bitcoin’s macro momentum to remain intact, sustained accumulation by new participants is critical. This trend could be the key to unlocking the next major price rally.

Hodl waves

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Bitcoin Price Prediction: Key Levels to Watch

As of now, Bitcoin is trading around $97,332, with immediate support expected at $95,000. Analysts suggest that holding this level is crucial for a recovery.

The next milestone is flipping into support. If Bitcoin achieves this, it could pave the way for a rally back above the psychological $100,000 mark.

Breaking this barrier would likely restore market confidence and attract additional buyers, setting the stage for a bullish continuation.

However, failure to hold the $95,000 level could lead to further declines. The next significant support lies at $89,800.

A drop to this range would invalidate the current bullish outlook and could signal a potential bearish phase for the market.

Comparing Today’s Market to Past Bull Runs

Bitcoin’s recent performance echoes patterns seen during the 2015–2018 bull run. Heavy profit-taking from mid-term holders and a rise in demand from new buyers are hallmark signs of an impending rally.

During past bull markets, the redistribution of Bitcoin wealth from long-term holders to newer investors played a pivotal role in driving prices higher.

This cycle of accumulation and redistribution is once again in motion, signaling that Bitcoin could be gearing up for another significant move.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

The Road Ahead: Bullish or Bearish?

The coming weeks will be critical for Bitcoin’s trajectory. Here are the key factors to watch:

Demand Growth: Continued accumulation by new market participants is essential for sustaining the rally.

Key Support Levels: Holding above $95,000 and flipping into support will be pivotal.

Market Sentiment: Positive sentiment could drive prices back above $100,000, reigniting bullish momentum.

Profit-Taking: If profit-taking intensifies without sufficient demand, Bitcoin could face a bearish downturn.

Bitcoin bull run

Bitcoin’s recent surge and subsequent pullback are part of a familiar cycle that has historically preceded major bull runs.

While the path forward depends on a delicate balance of demand and market sentiment, the data shows promising signs.

As new buyers enter the market and long-term holders redistribute their wealth, Bitcoin is poised for another potential rally.

Whether it’s a push above $100,000 or a test of lower support levels, the next chapter in Bitcoin’s story is one to watch closely.

For investors, this is a time to stay informed, monitor key levels, and prepare for opportunities in what could be the next phase of Bitcoin’s remarkable journey.

Enjoyed this? Join 5,211+ crypto enthusiasts in our newsletter to level up your game! 🚀 Don’t forget to clap if you want more like this!