- NEXTBULL Masterclass

- Posts

- A New Financial Frontier: Tokenization of Real-World Assets (RWA)

A New Financial Frontier: Tokenization of Real-World Assets (RWA)

Imagine a future where every asset you own, from stocks and bonds to real estate and artwork, is securely represented on a blockchain.

This isn’t a distant dream — it’s happening now. Tokenization, the digital transformation of real-world assets, is revolutionizing global finance.

This groundbreaking shift is more than a technological evolution; it’s a reimagining of financial systems that have long been burdened by inefficiencies and exclusivity.

With major institutions spearheading this movement, the era of tokenized assets is poised to redefine investment as we know it.

Let’s explore the depths of this transformation and understand how it’s shaping the future of finance.

Tokenization

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Understanding Tokenization

At its core, tokenization converts real-world assets into digital tokens on a blockchain. These tokens serve as certificates of ownership, representing claims on tangible or financial assets such as real estate, stocks, or bonds.

Blockchain technology acts as the backbone, ensuring a secure, transparent, and immutable ledger for these transactions.

The tokenization process starts with off-chain standardization, where details such as asset value, ownership, and legal documentation are verified and digitized.

Once formalized, tokens are minted on the blockchain. These tokens can be fractionalized, making it easier to trade smaller portions of high-value assets.

They are then listed on centralized or decentralized marketplaces, enabling global accessibility.

RWA tokenization

A New Era of Financial Inclusion

For decades, high-value assets like commercial real estate or fine art were accessible only to the ultra-wealthy or institutional investors.

Tokenization is dismantling these barriers. By enabling fractional ownership, individuals can now own portions of assets that were once exclusive.

Picture owning a fraction of a Manhattan skyscraper or a Picasso painting. Tokenization democratizes investment, allowing broader participation in traditionally illiquid markets.

It’s not just about accessibility; it’s about inclusivity. By breaking assets into smaller, tradable units, tokenization enables both retail and institutional investors to diversify their portfolios without sacrificing efficiency.

Tokenized assets eliminate intermediaries, streamline transactions, and reduce costs. Paperwork and settlement times that once spanned weeks can now be executed in seconds on a blockchain.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

The Current State of RWA Tokenization

In 2024, the tokenized real-world asset (RWA) market surpassed $13 billion in total market capitalization, fueled by sectors like tokenized U.S. Treasuries and private credit.

Institutional giants like BlackRock and Franklin Templeton were spearheading this movement:

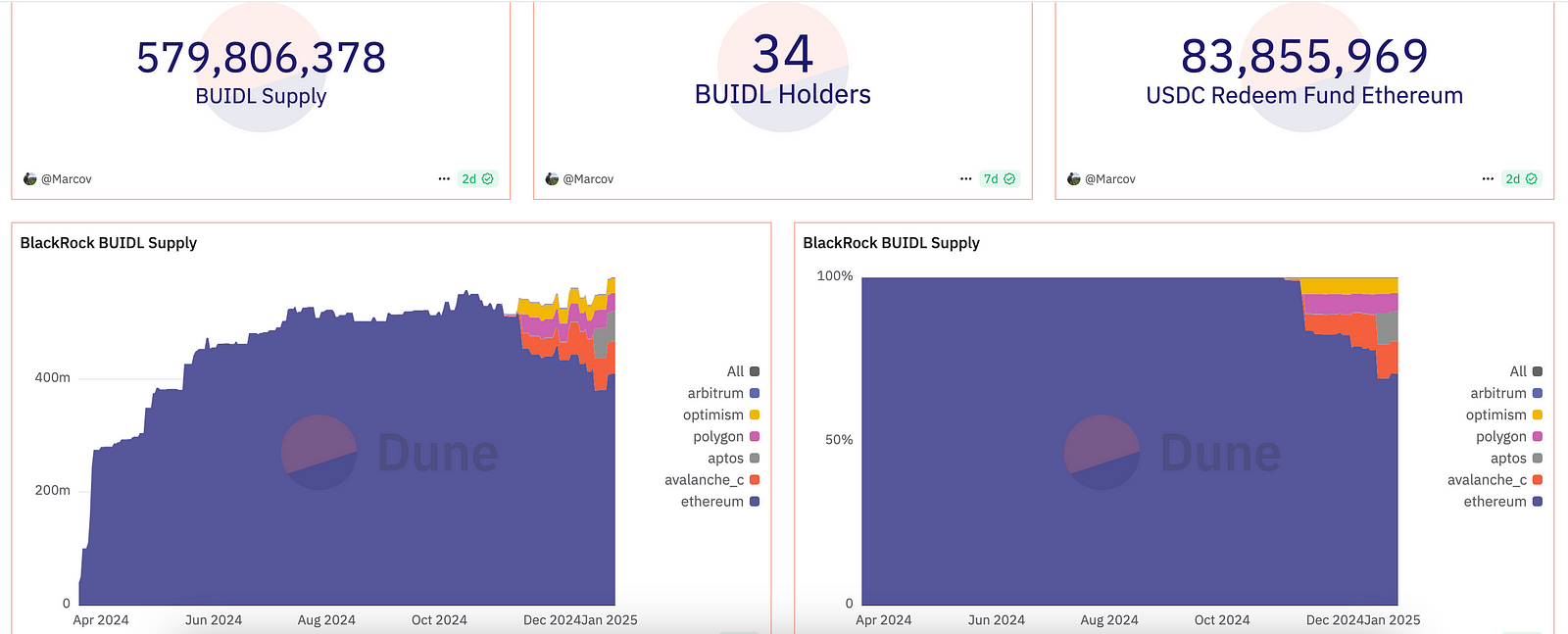

BlackRock’s BUIDL Treasury Fund: This tokenized U.S. Treasury fund amassed over $530 million in assets.

Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX): Redefining mutual funds through blockchain.

BlackRock’s BUIDL

While tokenized assets still represent a small fraction of the global financial market, their potential is enormous.

Continued adoption could see tokenized assets becoming integral to the global financial system in the coming years.

Market Distribution of Tokenized RWAs

The tokenized RWA market reached $12 billion in 2024, with growth across various financial instruments:

1. Tokenized Treasuries and Bonds

Market Size: From $769 million to over $2.2 billion in 2024.

Key Player: BlackRock’s BUIDL Treasury Fund leads with over $500 million in market cap.

Scope: Beyond U.S. Treasuries, the broader bond market, including corporate bonds, stands at $80 million.

2. Private Credit

Market Size: On-chain private credit surged to $9 billion, growing 56% in the past year.

Dominant Player: Figure leads with $8.3 billion in Total Value Locked (TVL).

Use Cases: Provides new diversification and liquidity opportunities for institutional investors.

3. Commodities

Market Size: Dominated by tokenized gold products like PAXG and XAUT, exceeding $1 billion.

Gold’s Dominance: Other commodities like silver and platinum contribute minimally.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Tokenized Market

The Potential of RWAs by 2030

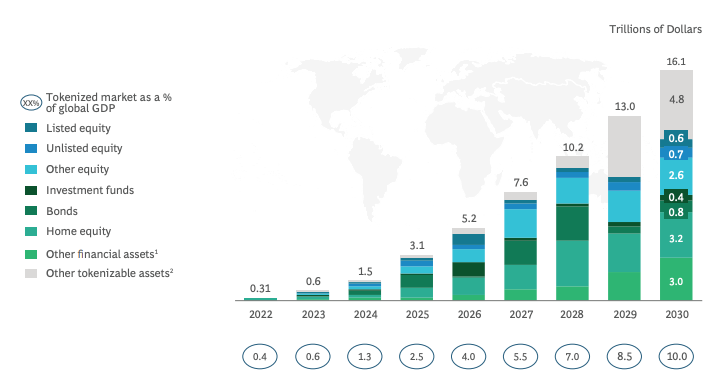

The growth trajectory for tokenized RWAs is staggering. Industry projections vary, but all indicate significant potential:

Boston Consulting Group (BCG): Estimates tokenized funds could reach $600 billion by 2030, comprising 1% of global mutual funds and ETFs.

McKinsey & Company: Predicts the tokenized RWA market could range from $1 trillion to $4 trillion by 2030, encompassing a broader asset range.

While regulatory hurdles and technological infrastructure remain challenges, these projections highlight the transformative potential of tokenized assets.

Key Tokens Shaping the Future of RWAs

Several tokens stand out in the tokenized economy:

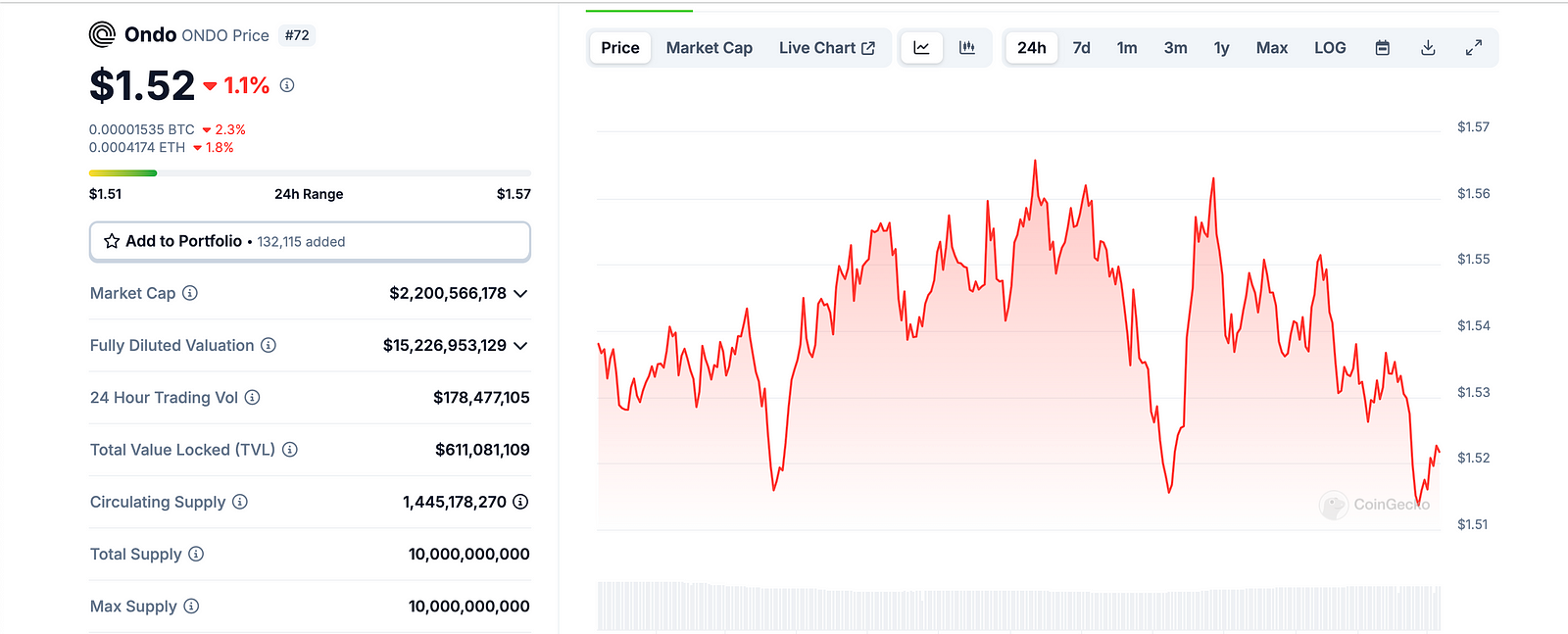

1. ONDO

Overview: Bridges blockchain with conventional financial assets, focusing on bonds, ETFs, and U.S. Treasuries.

Key Catalysts: SEC approval of spot Ethereum ETFs and Coinbase listing.

Technical Insights: Trading at $1.52, with potential to retest its all-time high of $2.

Ondo price chart

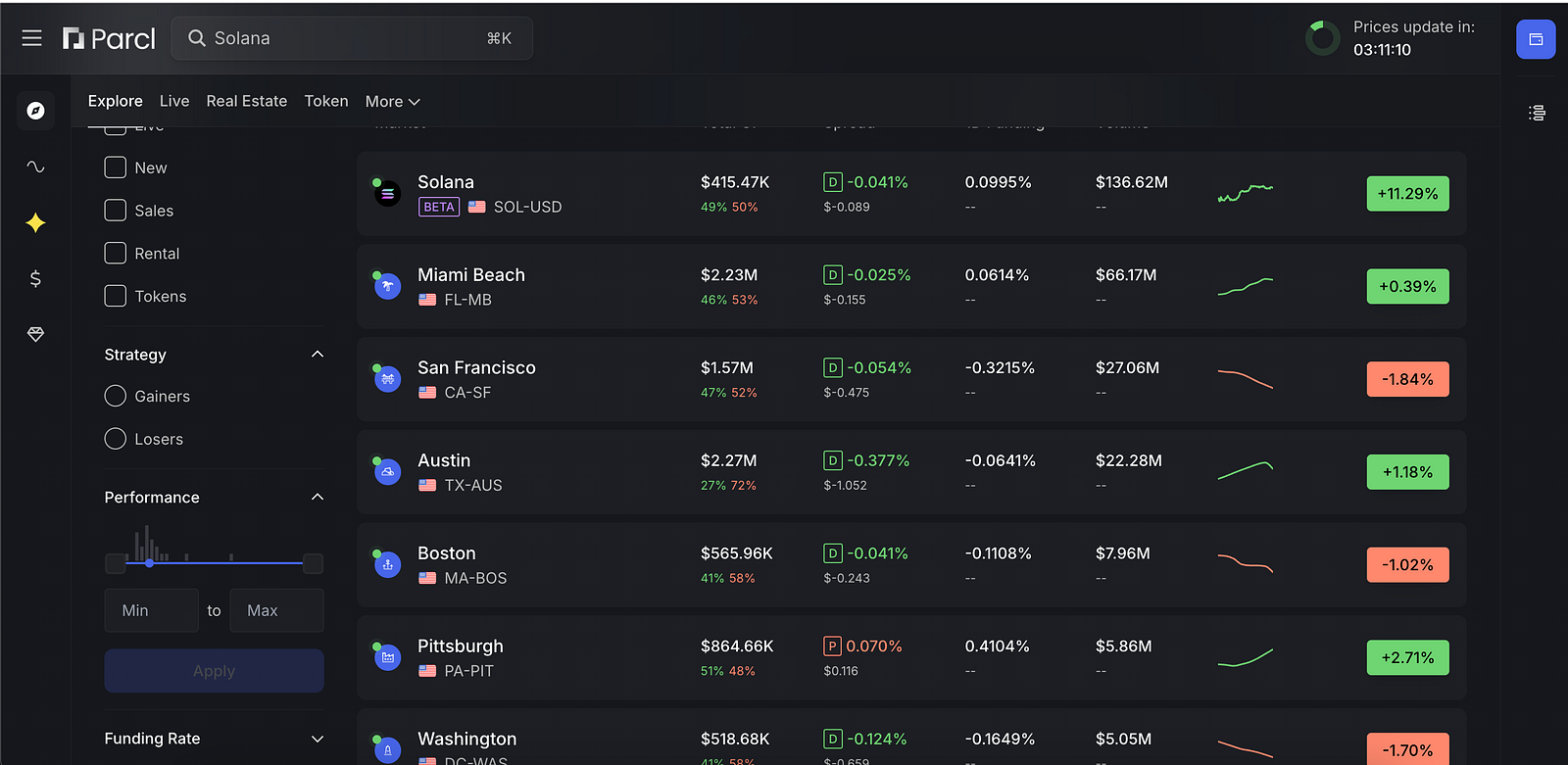

2. PARCL

Overview: Specializes in tokenized real estate, enabling fractional ownership.

Key Catalysts: Blockchain-driven automation and geographic portfolio diversification.

Technical Insights: Currently consolidating around $0.3594, with resistance at $0.472.

PARCL

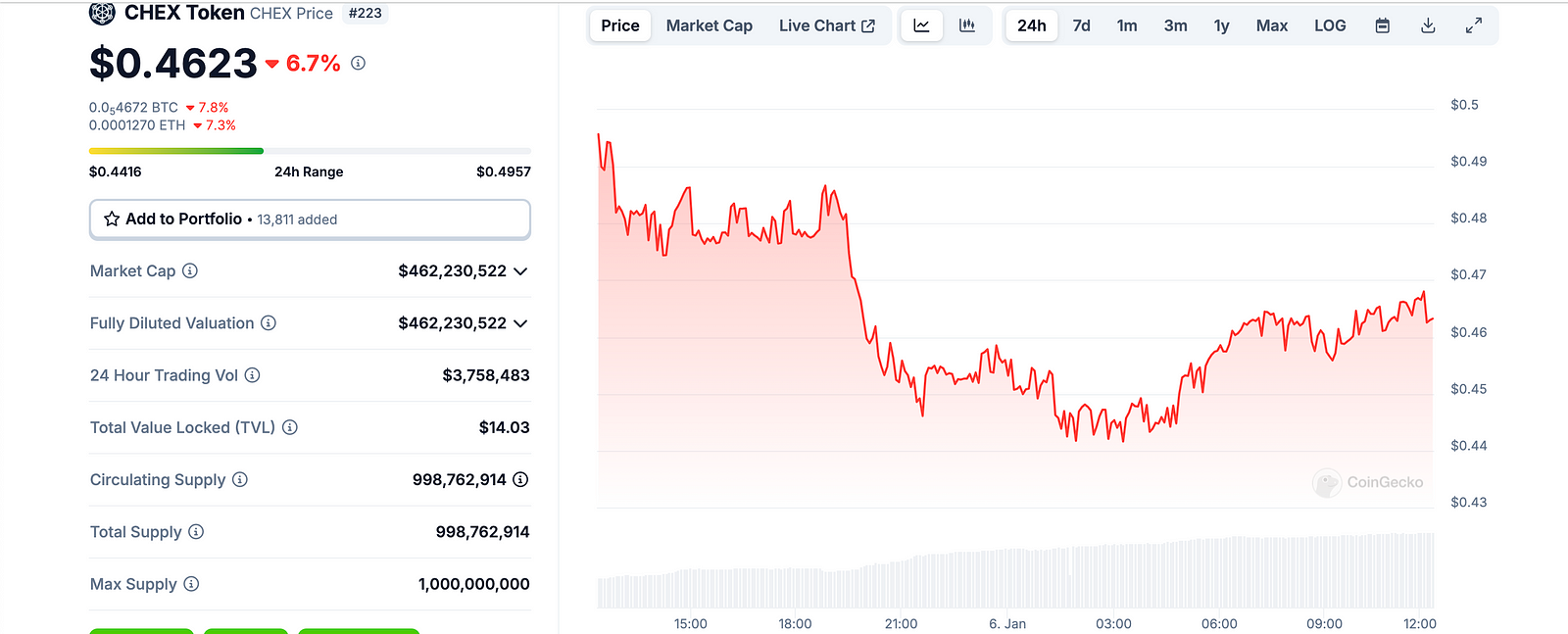

3. Chintai (CHEX)

Overview: Tokenizes assets like carbon credits and real estate on a permissioned blockchain.

Key Catalysts: Regulatory compliance and sustainable investment focus.

Technical Insights: Trading at $0.4623, with potential to break its all-time high of $0.9

Chex price chart

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Overcoming Challenges

Despite its promise, tokenization faces hurdles:

Regulatory Uncertainty: Varying jurisdictional rules create complexities.

Off-Chain Intermediaries: Dependence on these can compromise decentralization.

Infrastructure Costs: Implementing robust systems is costly and complex.

However, advancements like zero-knowledge proofs, cross-chain bridges, and enhanced security protocols are paving the way for scalable solutions.

Zero Knowledge Proofs

A Tokenized Future

The tokenization of real-world assets is more than a trend — it’s the future of finance. While challenges remain, the foundations being laid today promise a more inclusive, efficient, and transparent financial system. For investors and institutions, the journey to a tokenized tomorrow offers unprecedented opportunities to reshape the world of finance.

Enjoyed this? Join 5,211+ crypto enthusiasts in our newsletter to level up your game! 🚀 Don’t forget to clap if you want more like this!