- NEXTBULL Masterclass

- Posts

- 10 Ways To Identify a Bull Market Peak

10 Ways To Identify a Bull Market Peak

The cryptocurrency bull market is a phenomenon that captivates investors worldwide.

It is a period of exhilarating growth, where prices surge, portfolios flourish, and the promise of financial independence feels within reach.

Yet, as history has repeatedly shown, every bull market eventually reaches its peak.

The ability to recognize the signs of an impending downturn is not just a skill — it is an essential strategy for preserving your gains and exiting the market with confidence.

Bull market. Image from Freepik

This guide will equip you with the knowledge to identify the critical indicators of a bull market top, ensuring you are not left vulnerable when the tide turns.

1. The Parabolic Rise: A Warning in Disguise

In the early stages of a bull market, price movements are often steady and sustainable. However, as the market approaches its peak, the price chart can take on a parabolic shape — a steep, almost vertical ascent.

This phenomenon, known as a “blow-off top,” is characterized by rapid, unsustainable price increases driven by euphoria rather than fundamentals.

Historical examples, such as Bitcoin’s surges in late 2017 and 2021, illustrate this pattern. While the upward trajectory may feel exhilarating, it is often a precursor to a sharp correction.

A parabolic rise is a signal to exercise caution. When prices appear to defy gravity, it is time to reassess your position.

BTC Parabolic rise

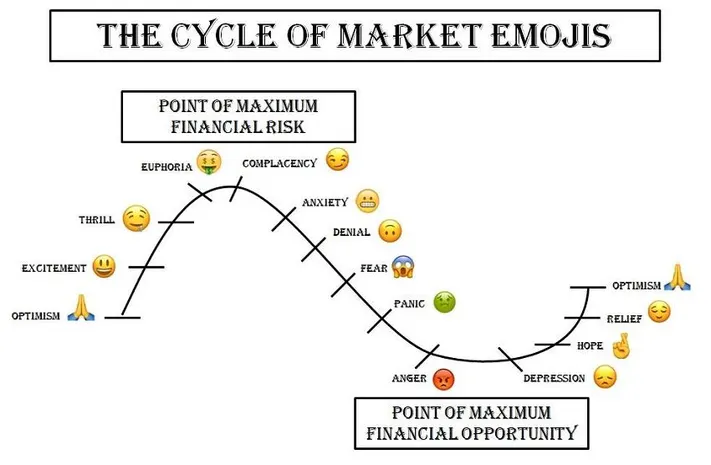

2. Euphoria: When Everyone Joins the Frenzy

A hallmark of a market peak is the widespread sense of euphoria that permeates even the most unlikely circles. What begins as excitement among seasoned investors soon spreads to mainstream audiences. News outlets feature daily cryptocurrency updates, celebrities endorse obscure tokens, and even those with no prior interest in finance begin to speculate.

When your grandmother asks whether she should invest in Ethereum, it is a clear indication that the market has reached a speculative frenzy. This level of irrational exuberance often precedes a downturn.

Extreme optimism among the general public is a red flag. When everyone is bullish, it is time to consider taking profits.

3. Heightened Volatility: The Market’s Nervous Tremors

While volatility is inherent to cryptocurrency markets, excessive price swings can signal an impending reversal. During the late stages of a bull market, prices may experience dramatic fluctuations — surges followed by sharp declines — within short timeframes.

This erratic behavior reflects a market on edge, where uncertainty and speculation dominate. Such conditions often indicate that the market is nearing exhaustion.

Increased volatility is a warning sign. If the market feels unstable, it may be time to reduce exposure.

4. Technical Indicators: The Market’s Exhaustion Signals

Technical analysis provides valuable tools for identifying overbought conditions. Indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can offer insights into market sentiment.

For instance, an RSI reading above 70 for an extended period suggests that the market is overbought. Similarly, bearish divergences in the MACD or Bollinger Bands stretched to their limits indicate potential exhaustion.

Pay close attention to technical indicators. When they signal overbought conditions, it is prudent to prepare for a correction.

Technical indicators

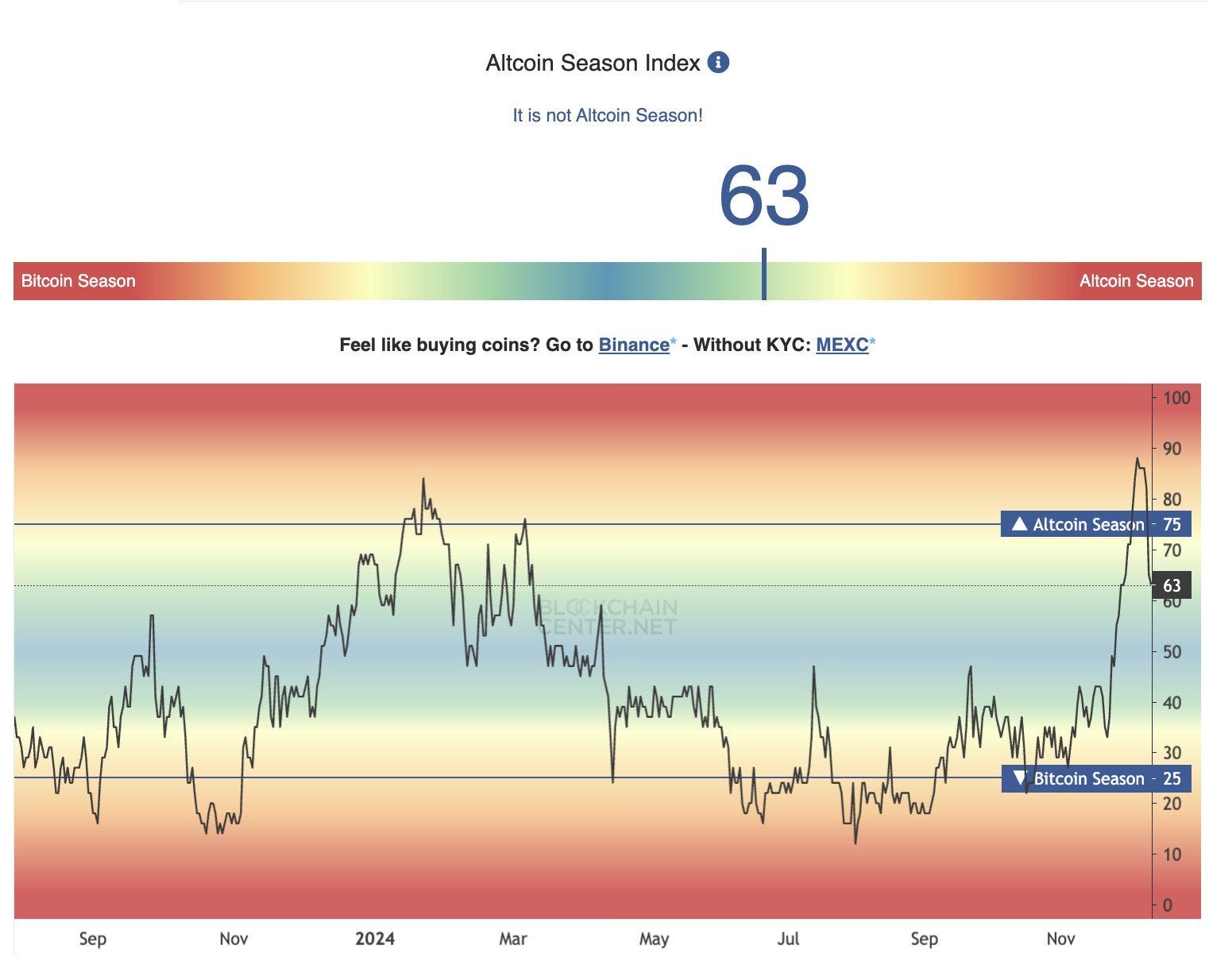

5. The Altcoin Surge: A Sign of Speculative Excess

As Bitcoin’s growth slows during the later stages of a bull market, capital often flows into altcoins. This “altcoin season” is marked by the rapid appreciation of smaller, riskier assets, including meme coins and low-cap tokens with little fundamental value.

While this phase can be highly profitable, it is also a sign of speculative excess. When investors chase high-risk assets with no clear utility, it often indicates that the market is nearing its peak.

The proliferation of speculative altcoin investments is a cautionary signal. Proceed with care.

Altseason Index

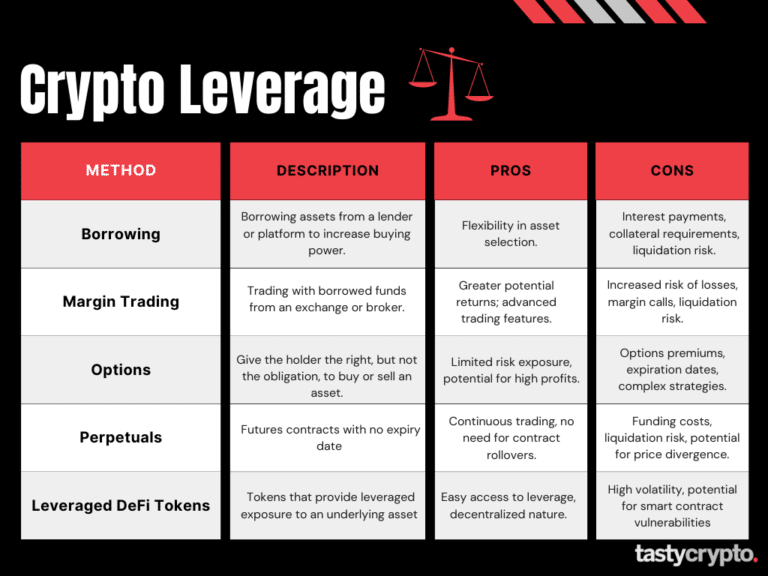

6. Leverage Overextension: A Ticking Time Bomb

The use of leverage amplifies both gains and losses. During a bull market, traders often increase their leverage to maximize returns, leading to inflated funding rates on exchanges.

However, excessive leverage creates a fragile market structure. Even a minor price correction can trigger a cascade of liquidations, exacerbating downward pressure.

High leverage across the market is a risk factor. When greed drives borrowing, the potential for a sharp reversal increases.

Leverage

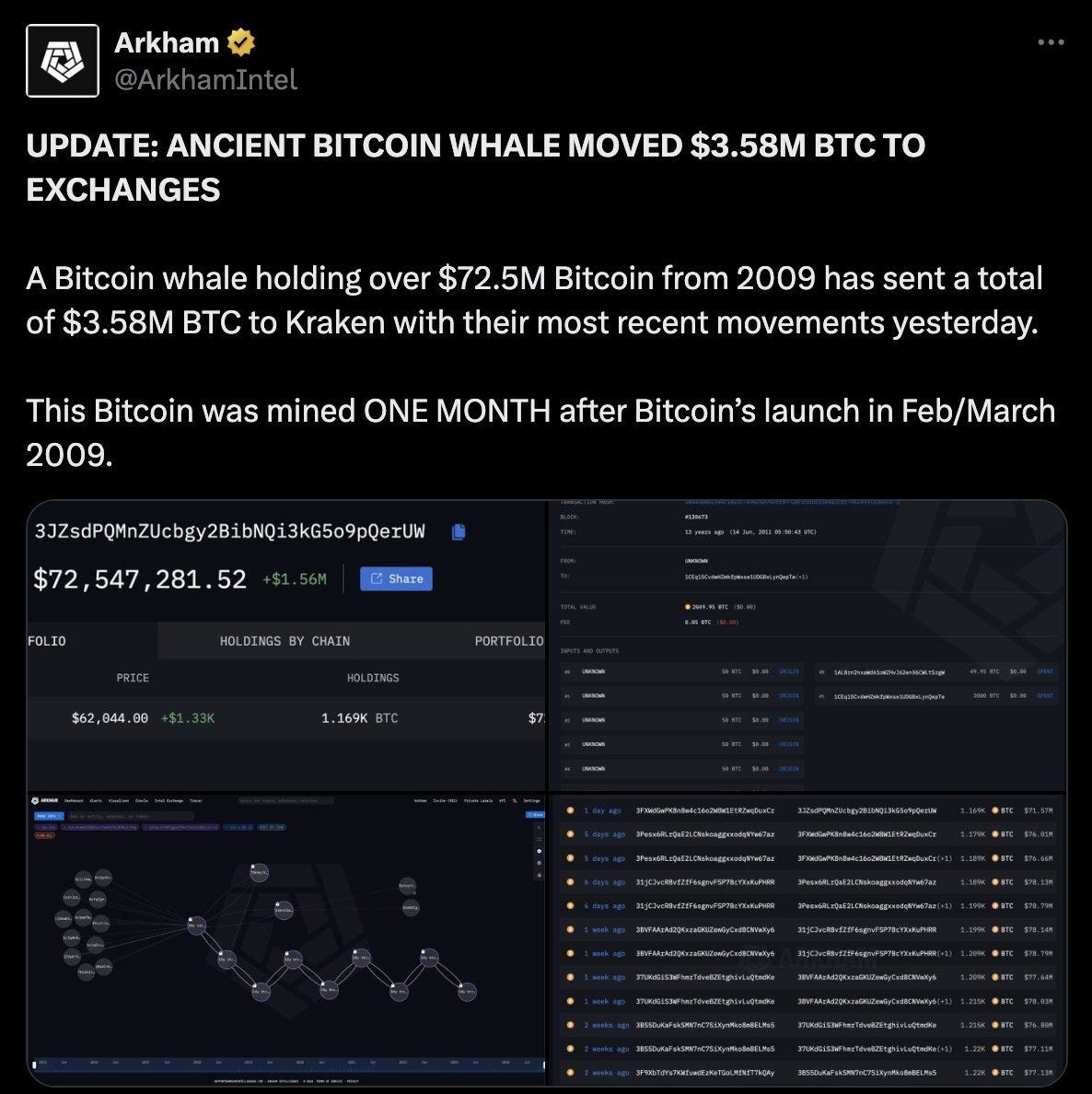

7. Whale Activity: Following the Smart Money

Large holders, or “whales,” often provide early signals of market sentiment through their actions. When whales begin transferring assets to exchanges, it is typically a precursor to selling.

On-chain analytics tools, such as the Spent Output Profit Ratio (SOPR), can reveal whether investors are realizing significant profits. If whales are cashing out, it may be wise to follow suit.

Monitor whale activity. When large holders exit, it is a strong indicator that the market may be peaking.

Image by Arkham Intel

8. The MVRV Ratio: A Measure of Market Health

The Market Value to Realized Value (MVRV) ratio compares the market capitalization of a cryptocurrency to its realized capitalization. Historically, an MVRV ratio above 3.5 or 4 has signaled overvaluation and preceded significant corrections.

This metric provides a macroeconomic perspective on market conditions, helping investors gauge whether assets are overpriced.

An elevated MVRV ratio is a warning sign. When the market is overvalued, it is time to secure profits.

MVRV ratio

9. Diminishing Returns: The Fizzle Before the Fall

In the final stages of a bull market, each successive rally tends to lose momentum. Prices may reach new highs, but the gains are smaller and less sustained. This pattern of diminishing returns suggests that the market is running out of steam.

Weakening rallies indicate waning momentum. When the market struggles to maintain its upward trajectory, a reversal may be imminent.

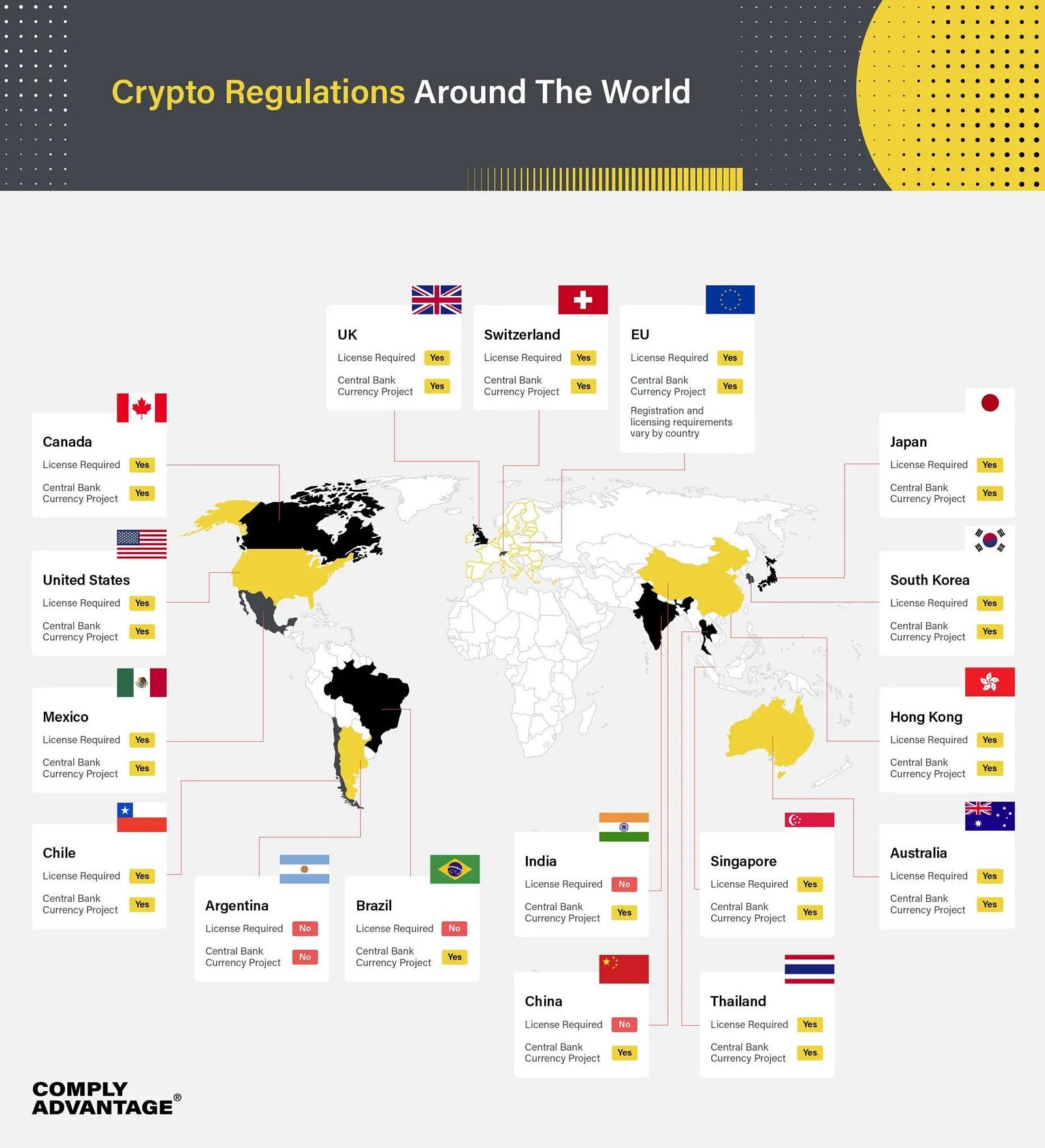

10. External Catalysts: The Unpredictable Wildcard

Even the most robust bull markets are vulnerable to external shocks. Regulatory actions, macroeconomic shifts, or geopolitical events can abruptly alter market dynamics.

For example, a sudden increase in interest rates or a regulatory crackdown can trigger widespread sell-offs.

Stay informed about global developments. External factors can swiftly end a bull market, so remain vigilant.

Crypto Regulations

Conclusion: The Art of Timely Exit

Identifying a bull market peak is not about predicting the exact top but recognizing the confluence of warning signs.

By monitoring price action, market sentiment, technical indicators, and on-chain data, you can make informed decisions about when to reduce exposure and secure profits.

The cryptocurrency market is cyclical, and opportunities will always return. The key is to ensure you are financially and psychologically prepared to capitalize on them.

Do not be the investor who stays too long at the party. When the signs are clear, exit with confidence and preserve your gains for the next cycle.